- USD/JPY has risen from the lows amid optimism about trade and moderate comments from the Fed.

- The Trump-Xi summit and the Non-Farm Payrolls promise an intriguing start to the second half of 2019.

- Early July’s daily chart indicates further falls for the currency pair.

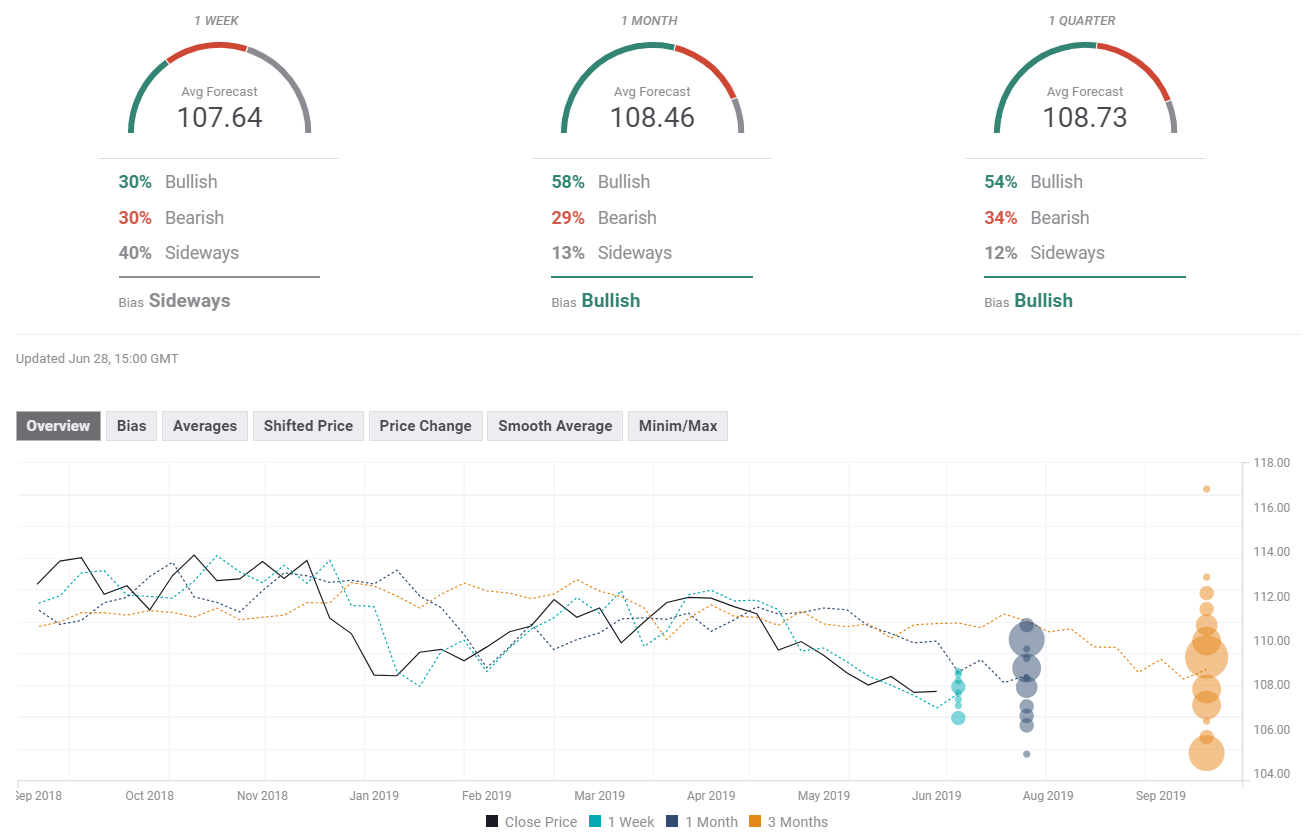

- Experts see sideways movement in the short-term and rises afterward.

What just happened: Fed moderates, trade in focus

The Federal Reserve has taken a step back from its dovish message – suggesting an interest rate cut in July may only serve as an “insurance policy” – and not the beginning of a series of rate reductions. James Bullard, President of the Saint Louis branch of the Federal Reserve, discarded the option of a 50 basis point cut that markets had hoped for. Fed Chair Jerome Powell did not refer directly to rates but highlighted the strengths in the economy.

Overall, the central bank has moderated expectations for looser monetary policy and pushed the dollar higher.

US data has been mixed. Durable goods orders dropped by 1.3% – worse than had been anticipated – but the non-defense ex-aircraft component surprised with an increase of 0.4%.

The final read of GDP has shown that the US economy grew by 3.1% annualized in the first quarter of the year – as expected. On the one hand, consumer expenditure was downgraded. On the other hand, underlying inflation was surprisingly revised to the upside.

Trade has been in the spotlight ahead of the all-important summit between President Donald Trump and his Chinese counterpart Xi Jinping. Markets were cheered by reports that both sides agreed to a “trade truce” – no new tariffs during a fresh round of negotiations. However, Trump threatened to slap more duties, and China would like to remove all the levies imposed by the US in the past year. At the time of writing, uncertainty remains high.

In Japan, the Bank of Japan’s meeting minutes document has shown concern about low inflation and readiness to add more monetary stimulus. However, the BOJ seems to be short of additional policy measures as Japanese bond yields are already at rock-bottom levels, and the interest rate is negative at -0.10%.

The yen temporarily gained ground amid tensions in the Middle East. Iran downed a US drone, and Trump was close to authorizing an airstrike in retaliation. The incident intensified tensions and also pushed oil prices higher.

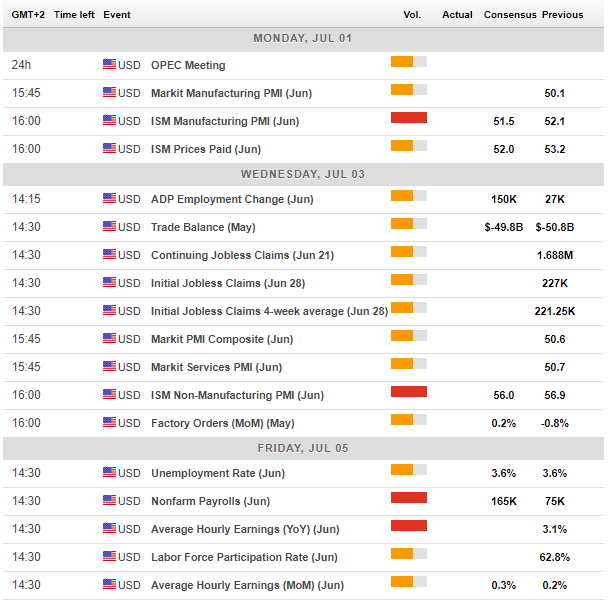

US events: Trump-Xi Summit, full NFP buildup

Trump and Xi will meet for a crucial summit early on Saturday while markets are closed – and the results will echo throughout the week. Current expectations are modest – an agreement to resume official trade talks and refrain from imposing new tariffs would please markets and may push USD/JPY higher.

If the leaders of the world’s largest economies strike a deal – a highly unlikely scenario – stocks may roar and dollar/yen could jump higher as well. However, a more likely scenario would be an inconclusive summit that will later lead to the US announcing new duties on China. In this adverse scenario – which has a medium probability – USD/JPY may not only retreat back to previous levels but plunge to new lows.

The economic calendar is packed with events that will initially compete for attention with the summit. June’s ISM Manufacturing PMI kicks off the week with an expected slide from 52.1 points recorded in June. The forward-looking indicator provides an insight into the manufacturing sector and its response to trade tensions and also serves as a hint towards the Non-Farm Payrolls figures on Friday.

Wednesday features two critical hints toward the NFP. The ADP Non-Farm Payrolls shocked investors in early June with a meager gain of only 27K positions – the lowest since March 2010. A return to normal with 150K posts is on the cards.

The second considerable release on Wednesday is the ISM Non-Manufacturing PMI. According to the survey, America’s services sector is growing at a robust clip – the score of 56.9 points reflects rapid growth. A minor decline is on the cards now.

Americans are celebrating Independence Day on Thursday, and thin liquidity is on the cards, allowing traders in other places to get ready for Friday’s big event.

The US labor market disappointed in May with an increase of only 75K jobs, adding to the case for a rate cut by the Fed. June’s report is projected to show a gain of 165K positions – closer to the longer-term averages. Another weak number may open the door to a large rate cut of 50bp in July or perhaps more than one move by the Fed. On the other hand, an increase of over 200K jobs may cast doubt on further interest rate reductions.

Wages have also fallen short of estimations in June with a monthly increase of 0.2% on a monthly basis and 3.1% on an annual basis. A faster growth rate is projected now.

Overall, a busy week beginning with the summit outcome and ending with the all-important jobs report – critical for the Fed decision – awaits traders.

Here are the top US events as they appear on the forex calendar:

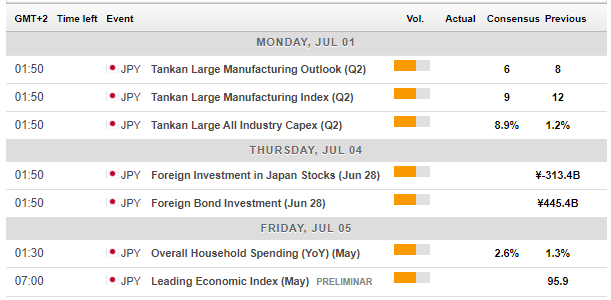

Japan: BOJ considers more stimulus

The Japanese yen remains a safe-haven that attracts flows in times of trouble. A failure of the Trump-Xi summit may boost the currency not only against the dollar but also in comparison to other currencies. US bond yields and stocks remain correlated with USD/JPY.

Apart from the Trump-Xi summit, a potential flare-up in US-Iranian tensions and concerns about North Korea’s nuclear ambitions may push the Japanese currency higher.

July begins with the Tankan surveys for the quarter that has just ended. All the measures are set to decline from previous levels. BOJ Governor Haruhiko Kuroda and his colleagues observe this report.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

USD/JPY has been trading below downtrend resistance that accompanies it since April. The line has proved decisive once again. While downside momentum has waned, the Relative Strength Index has exited oversold conditions – rising above 30 – and opens the door to further falls. The currency pair remains well below the 50, 100, and 200-day Simple Moving Averages.

Dollar/yen has some support at 107.50 which capped it in late June and served as support in January. It is followed by 107.00 which also worked as support in recent days. June’s low of 106.75 is critical support. Further down, 105.30 and 104.75 await the pair.

Some resistance awaits at the late June swing high of 108.10. It is followed by 108.70, which capped it during the first half of June. The round number of 109.00 provided support in May and now works as resistance. The next cap is at 109.90 which was a swing high in late May. Further up, 110.65 and 111.05 await it.

USD/JPY Sentiment

The upside correction may come to an end as the Trump-Xi summit may fall short of market expectations, and US data may continue to disappoint.

The FXStreet Poll shows a sideways trend in the short term but a bullish one in the medium and long terms. The average forecasts have been upgraded for all time frames. It seems that experts have reacted to the recent uptick.

-636973036189265923.png)