- Powell reduced concerns over further monetary tightening.

- The Fed noted weakness in the US economy.

- Investors are expecting GDP to grow in Q2.

Today’s USD/JPY outlook is bearish as investors react to the FOMC meeting. The dollar fell to a three-week low against the yen after Federal Reserve Chair Jerome Powell eased investors’ concerns about further aggressive monetary tightening.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The Fed increased the benchmark rate by an anticipated 75 basis points, bringing it closer to neutral. This caused the US currency to drop as low as 135.105 yen, its lowest level since July 6. The Fed also noted that while the labor market remains robust, other economic indicators have weakened.

The dollar-yen is quite sensitive to changes in US yields. The yields fell after Powell stated that he did not believe the economy was in a recession based on the strength of employment seen in recent payroll reports.

“The markets focused on his comments around the fact that we are getting very close to neutral.” “There’s potential now to slow down the pace of hikes, and the market likes that,” said Rodrigo Catril, a senior FX strategist at National Australia Bank.

Later today, when the GDP statistics are released, it will be known whether the US economy meets the criteria for a technical recession if it records two consecutive quarters of contraction.

USD/JPY key events today

Investors trading the USD/JPY currency pair will be informed of US news, such as the Gross Domestic Product (QoQ) (Q2). It is anticipated to increase from-1.6 to 0.5 percent. Janet Yellen will also make a speech later today. The initial unemployment claims report, which will provide insight into the US labor market, will also be watched closely by investors.

USD/JPY technical outlook: Bears strong enough to hit 135

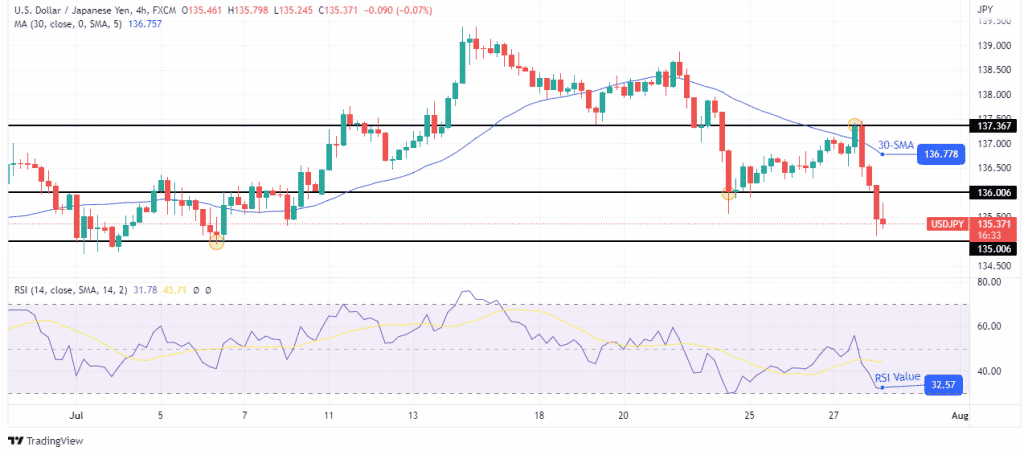

Looking at the 4-hour chart, we see the price in a strong bearish move. It has broken through the July 22 support at 136.006 and looks to be heading for the July 6 support at 135.006. The RSI is trading well below 50, favoring bearish momentum.

–Are you interested to learn about forex robots? Check our detailed guide-

If the price gets to 135.006, it might find support and retest 136.006 before continuing the downtrend. However, if bears continue this steep move, the price might break through 135.006.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.