- New York Fed president John Williams calls for more rate hikes to tame inflation.

- A strong labor market allows the Fed to continue hiking rates aggressively.

- Japan saw a decrease in real wages for a fifth consecutive month in August.

Today’s USD/JPY outlook is bullish. John Williams, the president of the New York Federal Reserve, stated on Friday that the US central bank needs to do more to reduce inflation and rebalance economic activity sustainably.

-If you are interested in forex day trading then have a read of our guide to getting started-

This can only mean a stronger dollar and a weaker yen. He made these remarks following the publication of employment data showing that the U.S. economy added 263,000 jobs in September, and the jobless rate decreased to 3.5% from 3.7% in August.

The U.S. economy, according to Williams, has “a very strong labor market, which is good except for very high inflation,” which is being combatted by increases in central bank rates. The employment report increased the likelihood of more pronounced interest rate increases.

According to government data released on Friday, Japan’s real wages decreased in August for the fifth consecutive month as a decline in the yen caused consumer prices to rise at the quickest rate in eight years, outpacing the country’s moderate pay increase.

While the Bank of Japan continues its massive monetary easing, policymakers urge businesses to raise wages to spark a sustainable growth cycle that will result in higher wages and more consumer and business spending. It would also ease the pain of inflation amplified by the currency’s decline to a 24-year low.

USD/JPY key events today

Investors will get the current account report from Japan that measures the difference in value between exported and imported goods during the reported month.

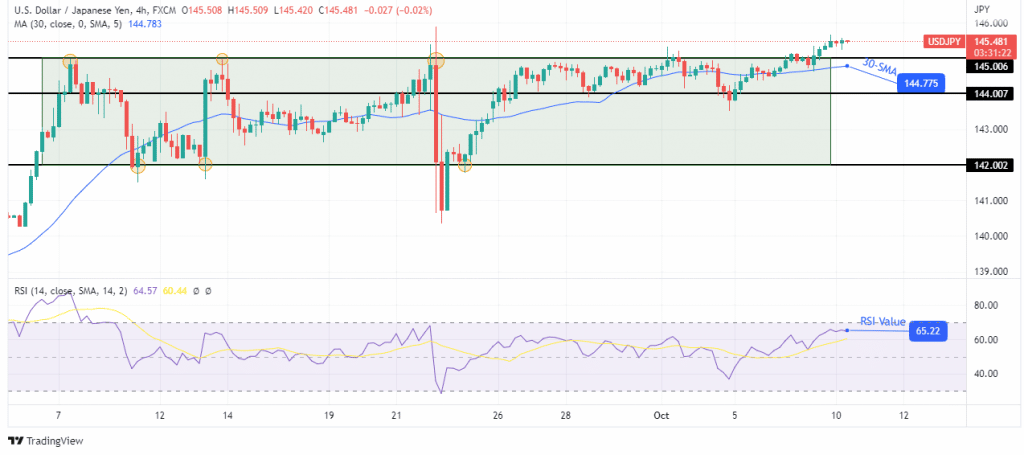

USD/JPY technical outlook: Bulls struggle to keep prices above the 145.00 key resistance

Looking at the 4-hour chart, we see the price trading above the 30-SMA and RSI above 50, showing an uptrend. The price has been trading within a tight range, with resistance at 145.006 and support at 144.007. Bulls were finally able to break above range resistance but are making small-bodied candles showing weakness in the move.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The break above 145.006 will only be confirmed by strong bullish momentum, which will come as a strong bullish candle. If this doesn’t happen, we might see the return of bearish momentum that will push the price back into the range.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.