- Fed policymakers made it clear that containing excessive inflation would be a “key factor.”

- The Bank of Japan intervened in the bond market on Wednesday.

- Investors are once again challenging the BOJ’s ultra-accommodative policy.

Today’s USD/JPY outlook is slightly bullish. At the most recent policy meeting of the US central bank, nearly all of the Federal Reserve’s policymakers supported a decision to further slow the interest rate increases. However, they also made it clear that containing excessive inflation would be the “key factor” in determining how much further rates needed to rise.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Minutes from Jan. 31–Feb. 1 meeting showed policymakers agreed rates would need to move higher but that the switch to smaller-sized hikes would let them adjust more closely with incoming data. This language suggested a compromise between officials concerned about a deteriorating economy and those convinced inflation would prove persistent.

The upside risks to inflation noted by decision-makers in the minutes are considerably more prominent today than when the (Federal Open Market Committee) last met. This is seen in recent inflation data and upward revisions to older figures.

On Wednesday, the Bank of Japan intervened in the bond market with emergency bond purchases and loan offerings after the yield on Japan’s 10-year government bonds crossed the upper end of its policy band for a second consecutive session.

Investors are again challenging the BOJ’s ultra-accommodative policy on interest rates. They expect the BOJ to end its yield curve control (YCC) policy when new governor Kazuo Ueda assumes office in April. This put a cap on the pairs’ gains.

USD/JPY key events today

Investors anticipate US economic data, such as the Q4 GDP report and the report on initial claims for unemployment benefits.

USD/JPY technical outlook: The bullish trend shows signs of weakness

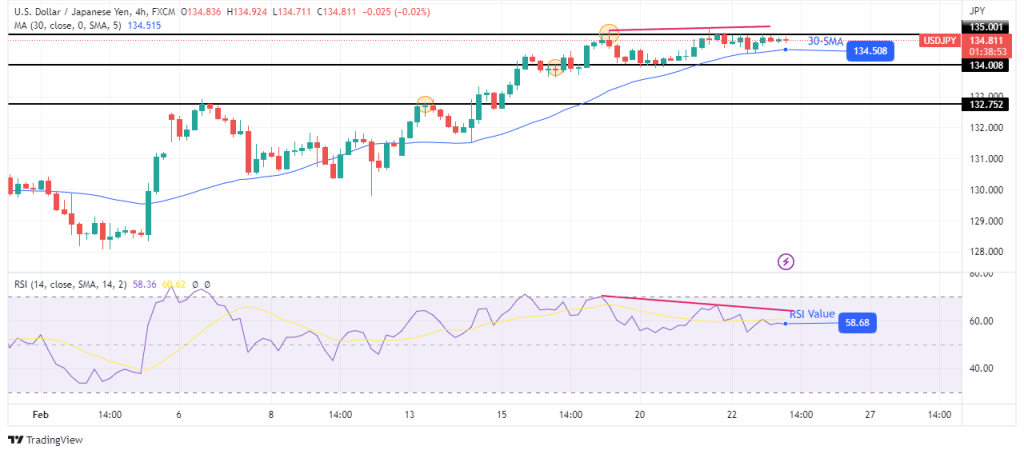

The 4-hour chart shows the price in a bullish trend, trading above the 30-SMA. However, the price has paused at the 135.00 resistance and shows signs of weakness. The RSI is trading above 50, a sign that bulls are in control, but it has also made a bearish divergence with the price, pointing to weakness.

–Are you interested in learning more about making money with forex? Check our detailed guide-

This weakness might lead to a trend reversal if the price breaks below the 30-SMA and starts making lower lows and highs. However, if bulls resume their strength, we might see a break above the 135.00 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money