- Japan’s wholesale inflation decelerated for the fourth consecutive month in April.

- Lower producer prices in Japan indicate a potential easing of consumer inflation.

- Japan’s core consumer inflation surged to 3.1% in March.

Today’s USD/JPY outlook is bullish. On Monday, data revealed Japan’s wholesale inflation decelerated for the fourth consecutive month in April. This drop was primarily due to a moderation in the rise of raw material costs. This indicates a potential easing of consumer inflation towards the Bank of Japan’s targeted 2% level.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

This data could dampen market expectations that the Bank of Japan will be compelled to pursue an early exit from its ultra-low interest rate policy.

According to the Bank of Japan’s data, the Corporate Goods Price Index experienced a 5.8% year-on-year increase in April. However, this represents a slowdown in the annual growth rate for the fourth consecutive month. The recorded increase surpassed the median market forecast of a 5.4% gain, following a 7.4% surge in March.

Analysts closely monitor wholesale price fluctuations because they serve as a leading indicator of consumer price trends. These observations provide insight into whether consumer inflation will reach a level that prompts the Bank of Japan to phase out its substantial stimulus measures.

In March, Japan’s core consumer inflation surged to 3.1%, while an index that excludes fuel costs experienced the fastest year-on-year growth in four decades. This development indicated a broadening of price pressure in the economy.

Furthermore, BOJ Governor Kazuo Ueda has stated that the central bank will hold on to its ultra-loose monetary policy. That is, unless there is strong domestic demand and higher wage growth.

USD/JPY key events today

Investors are not expecting any key releases from Japan or the United States. The pair will likely consolidate as investors await more economic data.

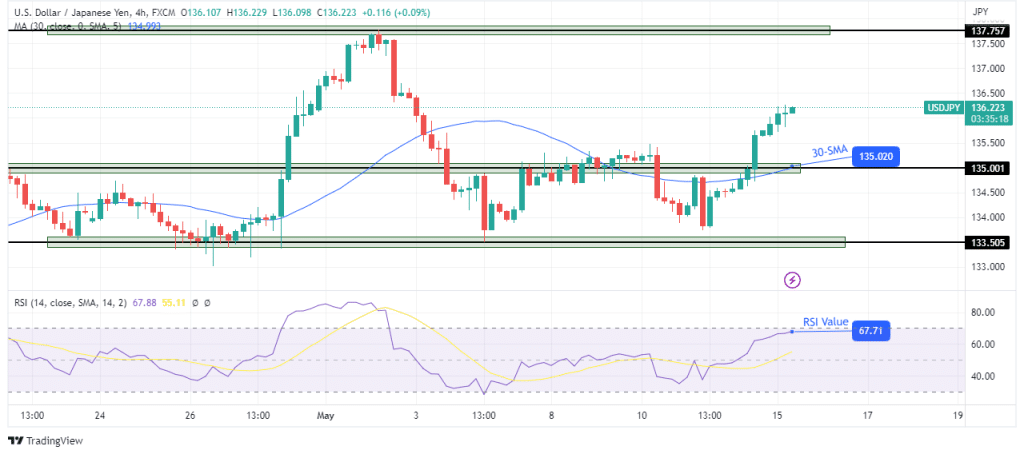

USD/JPY technical outlook: Bulls lead with a clear path to 137.75.

USD/JPY is now trading above the 135.00 key level, a big achievement for bulls. This move has strengthened the bullish bias by allowing the price to trade further above the 30-SMA. It has also led to stronger bullish momentum as the RSI nears the overbought region.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Given the bullish bias, the price will likely keep pushing higher. We might see a few pauses before we get to the next resistance at 137.75. If the price stays above 30-SMA, it might break above 137.75.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.