- Ueda said the BOJ must keep ultra-low interest rates to support the frail economy.

- Ueda hinted at the possibility of changing the BOJ’s YCC policy.

- The yen fluctuated between gains and losses against the dollar.

Today’s USD/JPY outlook is slightly bullish. Kazuo Ueda, the next head of the Bank of Japan (BOJ), warned of the risks of responding to cost-driven inflation with monetary tightening on Friday, stating that the central bank must keep ultra-low interest rates to support the frail economy.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Ueda hinted at possibly changing the BOJ’s bond yield curve control (YCC) in the future but said that the bank first needed to determine the best time and method. This indicates he won’t hurry to change the controversial policy.

According to Ueda, the recent inflation increase is primarily due to increased import costs for raw materials rather than robust demand. He added that the outlook for Japan’s economy was highly uncertain.

While investors analyzed Ueda’s remarks, the yen was erratic, fluctuating between gains and losses against the dollar.

In an unexpected move that first raised hopes of ending the unpopular YCC policy, the government announced earlier this month that the 71-year-old academic was its choice to lead the central bank.

With inflation beyond the BOJ’s objective, Ueda must carefully phase out YCC, which has come under fire from the public for distorting market dynamics and squeezing bank margins.

But he added that for now, the BOJ must keep an eye on whether the steps it made in December, such as enlarging the band around its yield target, can help mitigate the consequences.

USD/JPY key events today

Investors will pay close attention to the core Personal Consumption Expenditure (PCE) price index, the Fed’s preferred inflation measure. There will also be a new home sales report from the US.

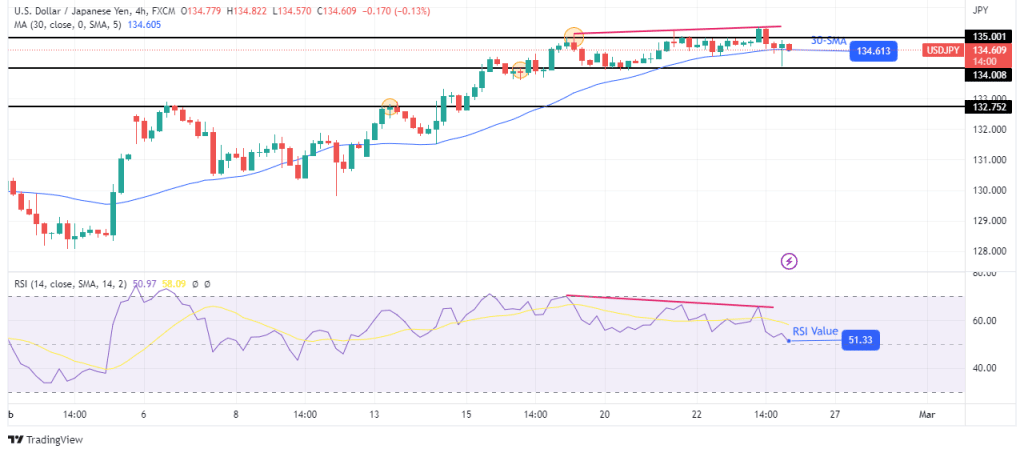

USD/JPY technical outlook: Bears attempt a break below the 30-SMA

The 4-hour chart shows the price trading in a tight range near the 30-SMA support and the 135.00 resistance level. As the price continues to crawl higher, the RSI is pushing lower and getting closer to the 50-mark. This is a sign that the bulls are losing momentum.

–Are you interested in learning more about making money with forex? Check our detailed guide-

At the same time, there is a bearish divergence that might allow bears to take over. The price has already attempted to break below the SMA. If bears take over, we might see it falling to 132.75 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money