- The Bank of Japan renewed its commitment to an ultra-easy policy on Friday, and the pair is recovering from its reaction.

- The divergence in policy between the Fed and the Bank of Japan could see the pair break above 135.5.

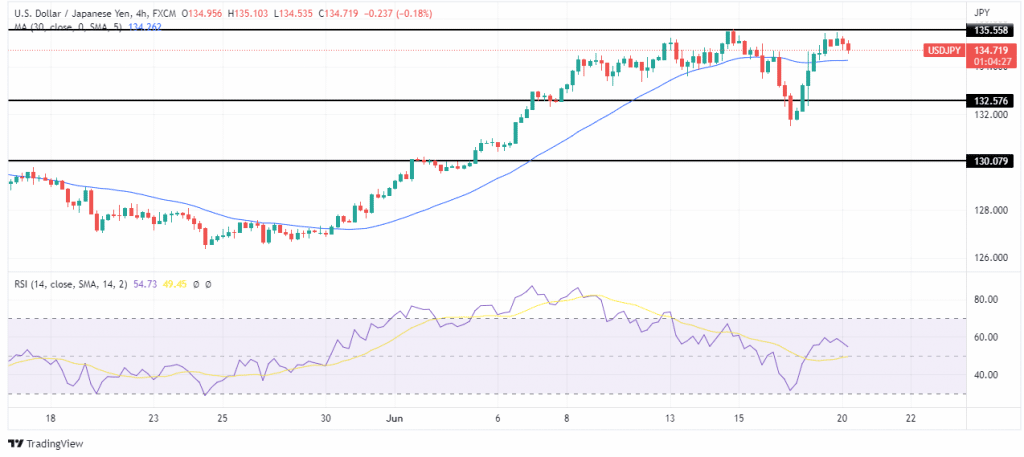

- The price is back to trading above the 30-SMA, and the RSI is above 50 in the charts, favoring bulls.

The USD/JPY investors are taking profits on Monday, pushing the price lower. This move comes after a very bullish close on Friday, brought on by the BoJ, which held its negative rates despite market pressure after several central banks raised rates last week. The yen is trading near a 24-year low against the dollar.

-Are you interested in learning about forex live calendar? Click here for details-

By contrast, the Fed said on Friday that it was committed to fighting inflation despite rising inflation risks, with some policymakers expecting another 75-bps hike at the July meeting.

Osamu Takashima, head of G10 FX strategy at Citigroup Global Markets Japan, said the dollar was pushing lower on Monday mainly because of the thin trading with the US observing a public holiday.

“Markets are still concerned about aggressive monetary tightening by the Fed, which is keeping US yields elevated, boosting the dollar,” he said. “The Fed has to tighten policy faster.”

He estimates that a 140 yen per dollar rate could be seen in the next 2 to 3 months if US long-term Treasury yields go up to around 3.75%, from 3.23%.

USD/JPY key events today

There won’t be any significant economic releases from the US or Japan, apart from a speech expected from FOMC member Bullard later in the day.

USD/JPY price technical analysis: Bulls back above the 30-SMA

Looking at the 4-hour chart, we see the price pushing higher after a big dip. The price is now trading above the 30-SMA, showing bulls are in charge of the market. Short-term bears are pushing the price to retest the SMA; if it holds, the next target would be 135.5. However, if the price breaks below the 30-SMA, it might consolidate before picking a side.

-Are you interested in learning about forex signals? Click here for details-

RSI is trading well above the 50 level and shows bullish momentum. The bias will remain bullish if RSI stays above 50 and the price keeps trading above the 30-SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money