- USD/JPY steps back from monthly high as US Treasuries, Asian stocks dwindle.

- 50-day SMA, monthly resistance line guard immediate upside.

- A two-week-old rising trend line on the bears’ radars.

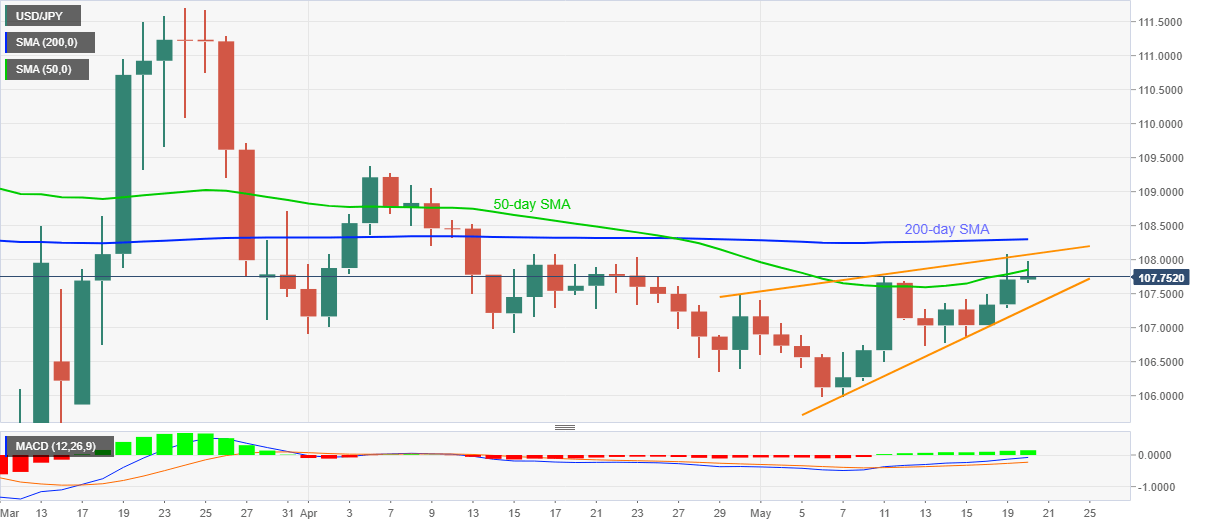

Following another U-turn from 50-day SMA, USD/JPY drops to 107.73 amid the initial trading hours on Wednesday. In addition to the said SMA, an upward slopping trend line from April 30 also guards the pair’s immediate upside.

That said, the market’s risk-tone also sours off-late and adds burden to the safe-haven pair. While portraying the risk-tone, US 10-year Treasury yields drop two basis points (bps) to 0.69% while the MSCI index of Asia-Pacific shares outside Japan drops 0.10% by the press time.

As a result, sellers are targeting a fortnight-old ascending trend line, at 107.30 now, during the further declines.

Though, a clear break below 107.30 will confirm a short-term rising wedge bearish formation, which in turn will magnify the quote weakness towards revisiting the monthly low near 106.00.

Alternatively, a 50-day SMA level of 107.75 and the aforementioned resistance line around 108.10 could keep the buyers in check.

During the pair’s rise past-108.10, a 200-day SMA level of 108.30 will act as another upside barrier before the April month top of 109.38.

USD/JPY daily chart

Trend: Pullback expected