- USD/JPY bears waiting to pounce, but bulls not throwing in the towel, yet.

- The daily chart’s W-formation is compelling for a downside playbook.

Further to the prior analysis, USD/JPY Price Analysis: Daily 38.2% correction before test of monthly resistance, and more recently, USD/JPY Price Analysis: Pre-Fed bullish prospects through daily trendline resistance, bulls are still in control with little let -up.

This is not ideal for the impatient trader seeking an opportunity all the way to the downside target in the 103.80s, nor for those looking to buy the correction from there either.

However, bullish commitments from the 104 figure, or thereabout, have paid off.

Meanwhile, the W-formation on the daily chart remains an opportunity to play for.

W-formation opportunity

In a prior analysis, from Jan 11th, it was explained that the neckline of the formation would be expected to be retested:

This is what we got:

While the price did actually grind a little deeper, the purpose of this illustration is to highlight the probability of a correction of the W-formation’s bullish impulse.

More often than not, the correction will make it all the way to test the formation’s neckline before the price continues higher, as it did in the case above when we roll forward the tape:

Meanwhile, we now have a similar scenario on the live charts.

Live market opportunity

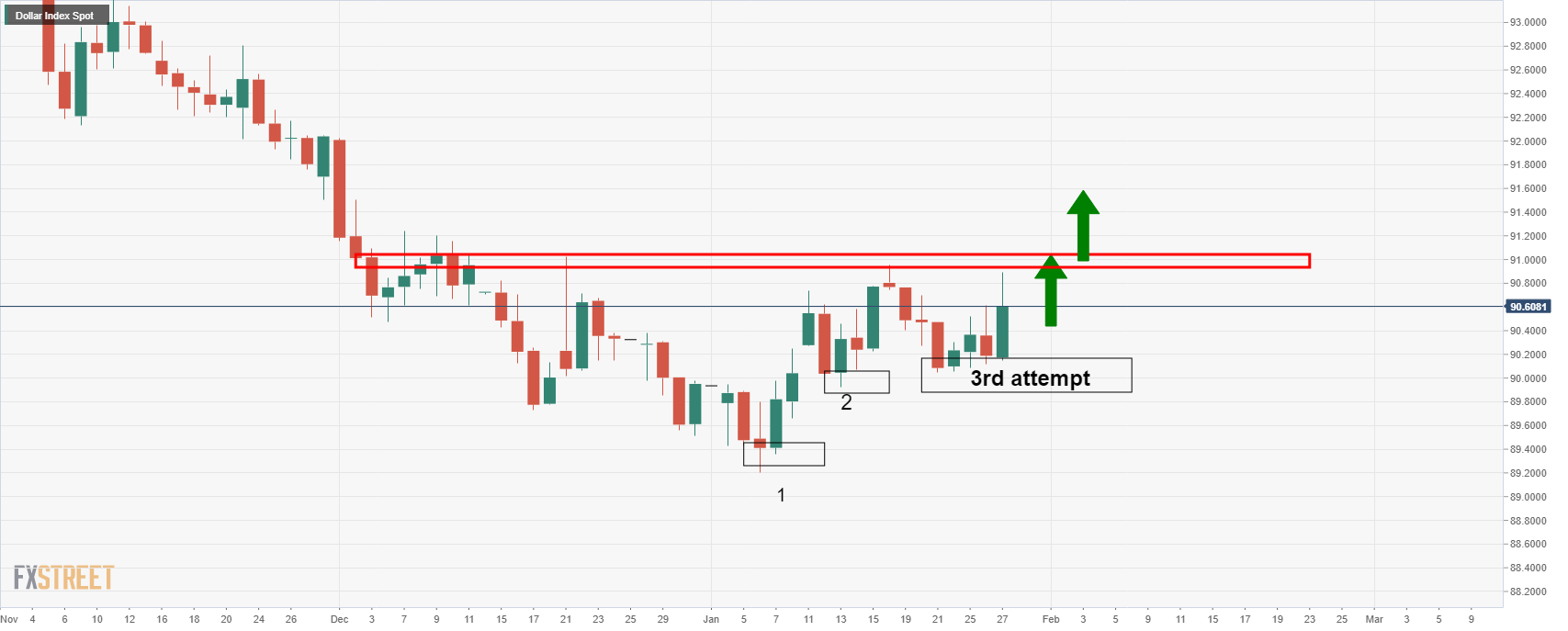

The US dollar (DXY) has since exploded to the upside in a third attempt to penetrate resistance, with no give back for the USD/JPY bears:

This has dragged USD/JPY along for the ride to create another W-formation:

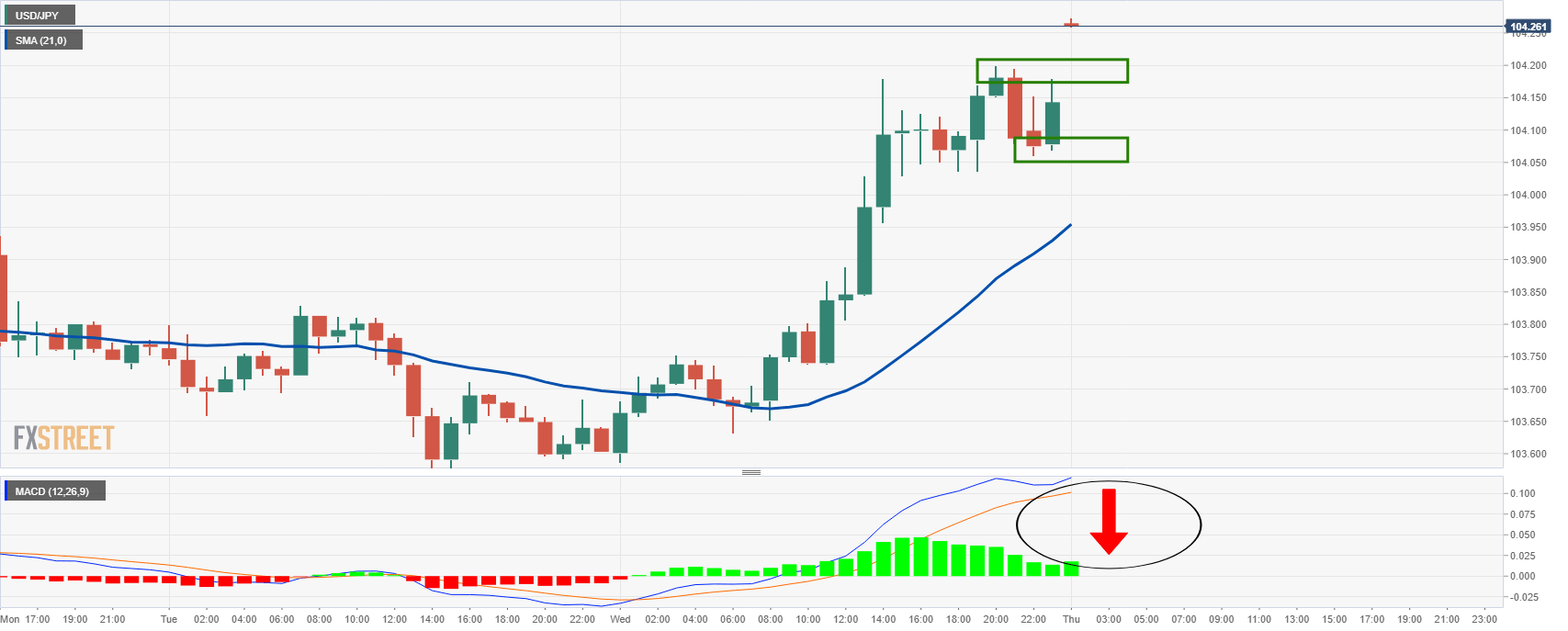

1-hour chart

However, the market is still in the hands of the bulls, but the 1-hour time frame can be monitored for a shift of environment from which would be expected to produce a short trading opportunity to the neckline of the daily formation.

-637459906728854996.png)