- USD/JPY holds onto recovery gains.

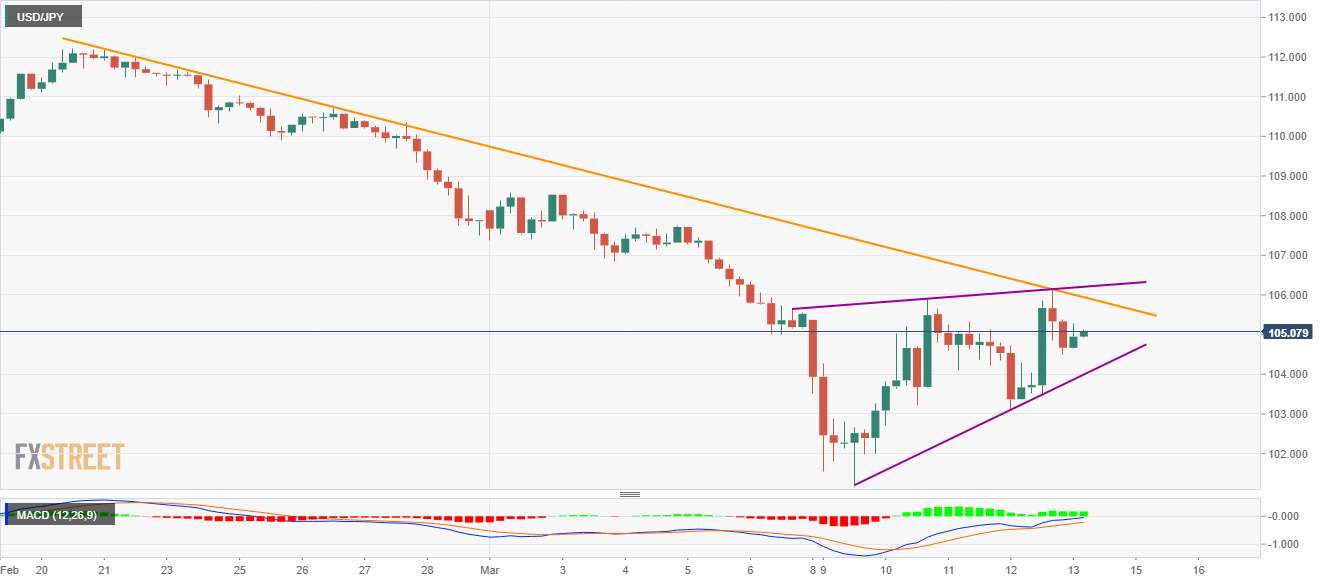

- A short-term bearish chart formation, three-week-old descending trend line check the buyers.

While showing resilience, based on the bullish MACD, USD/JPY pierces 105.00, to 105.10 with 0.42% gains, during the pre-European session on Friday.

Even so, a short-term rising wedge and a falling trend line from February 21 seem to question the bulls.

Hence, buyers will wait for entry beyond 106.20 with 105.95 acting as immediate resistance. In doing so, the monthly top near 108.55 could become their target.

Meanwhile, a downside break below 104.00 support will confirm the bearish technical pattern and can theoretically call 99.00 mark on the chart.

However, the recent lows near 101.00 and 100.00 psychological magnet are likely intermediate halts during the conditional fall.

USD/JPY four-hour chart

Trend: Further recovery expected