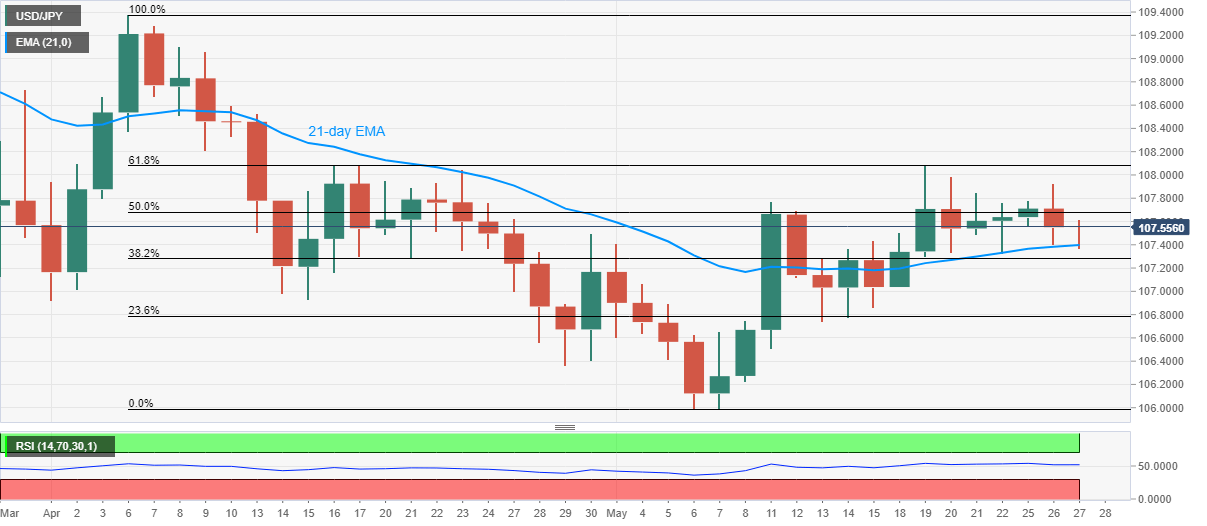

- USD/JPY extends recovery from 107.37, still red for the second day.

- 50% Fibonacci retracement guards immediate upside, 21-day EMA offers nearby support.

- Sideways churn likely to continue amid mixed catalysts.

USD/JPY pulls back from the daily bottom to 107.55 ahead of the European session on Wednesday. In doing so, the yen pair recovers from 21-day EMA while justifying the US dollar pullback amid fresh challenges to the risks.

Increasing odds of fresh sanctions on China recently weigh on the market’s risk-tone, which in turn dims the earlier optimism backed by hopes of the coronavirus (COVID-19) cure and economic restart.

That said, the US dollar index (DXY), a gauge of the greenback versus the major currencies, gains 0.15% from the lowest since May 01, 2020, to 99.15 by the press time.

As a result, the pair buyers may again confront 50% Fibonacci retracement of April-May fall, around 107.70. However, 61.8% Fibonacci retracement near 108.10 will be the key resistance limit to the pair’s further upside.

On the flip side, the quote’s daily closing below 21-day EMA level of 107.40 can aim for 107.00 ahead of resting on 23.6% of Fibonacci retracement near 106.77.

USD/JPY daily chart

Trend: Sideways