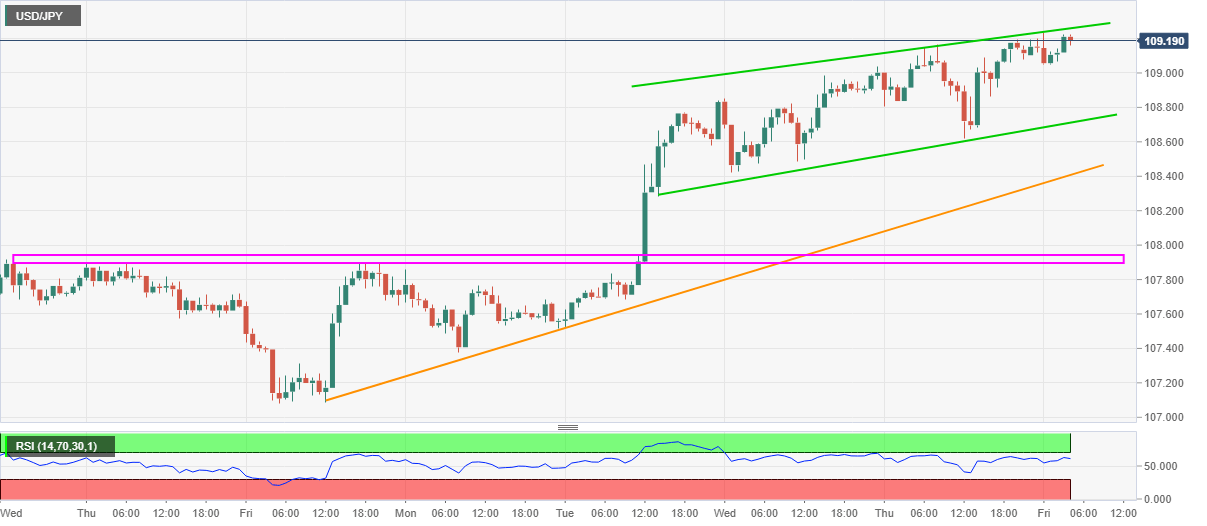

- USD/JPY stays near the upper line of a short-term rising channel.

- RSI conditions also weigh the quote near two-month high.

- US employment data will be the key catalyst to watch for near-term direction.

Following the latest U-turn from 109.07, USD/JPY seesaws near the intraday high of 109.24, up 0.05% on a day, during the early Friday.

However, the pair’s immediate moves have been confined by the resistance line of a three-day-old ascending trend channel amid nearly overbought RSI conditions.

Other than the technical factors, the market’s cautious mood ahead of the key US employment data also restricts the pair’s performance off-late.

Considering the pair’s repeated failures to cross the April month high, coupled with RSI conditions, the USD/JPY prices are likely to witness a pullback towards the channel’s support of 108.70.

Though, an upward sloping trend line from May 29 and multiple tops marked between May 27 and 31, respectively near 108.40 and 107.95/90, could restrict the quote’s weakness past-108.70.

Alternatively, an upside clearance of April month high of 109.40 can escalate the pair’s rise towards 110.00 round-figure while March tops near 111.75 could lure the bulls next.

USD/JPY hourly chart

Trend: Pullback expected