- USD/JPY bulls are stalling as the US dollar gives up some ground within its monthly correction.

- So long as USD/JPY holds above 103.50, a bullish bias persists.

Further to the prior analysis, USD/JPY Price Analysis: Bulls holding key support, upside bias persists, the yen has continued to attract a bid.

USD/JPY’s correction is not done yet as the price chips away at the 10-EMA where is meets the 20-EMA in the vicinity of the 38.2% Fibonacci retracement of the daily bearish impulse.

Meanwhile, the US dollar is giving back some ground following a series of bullish closes across the board which is also stalling the progress of USD/JPY.

The following is a top-down analysis that illustrates where patience is required by the bulls at this juncture.

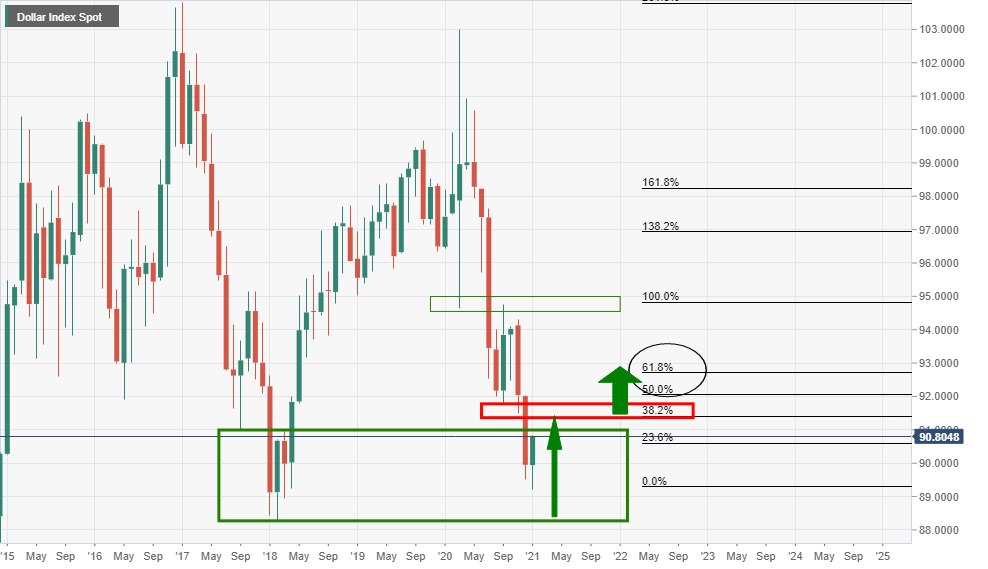

DXY monthly chart

Staying with the US dollar, against a basket of currencies, the DXY index has been correcting the monthly supply as follows:

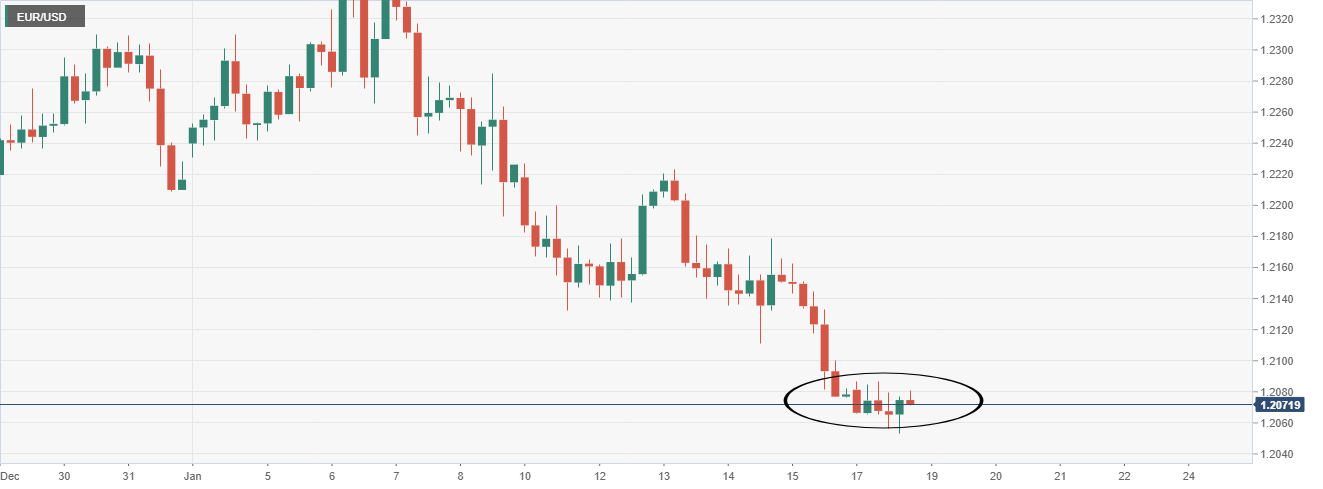

However, from a 4-hour perspective, the bullish impulse is in the process of a correction which will obviously weigh on USD/JPY during the retracement. The Japanese yen is weighted in the index by 13.6%, the second largest.

DXY, 4-hour chart

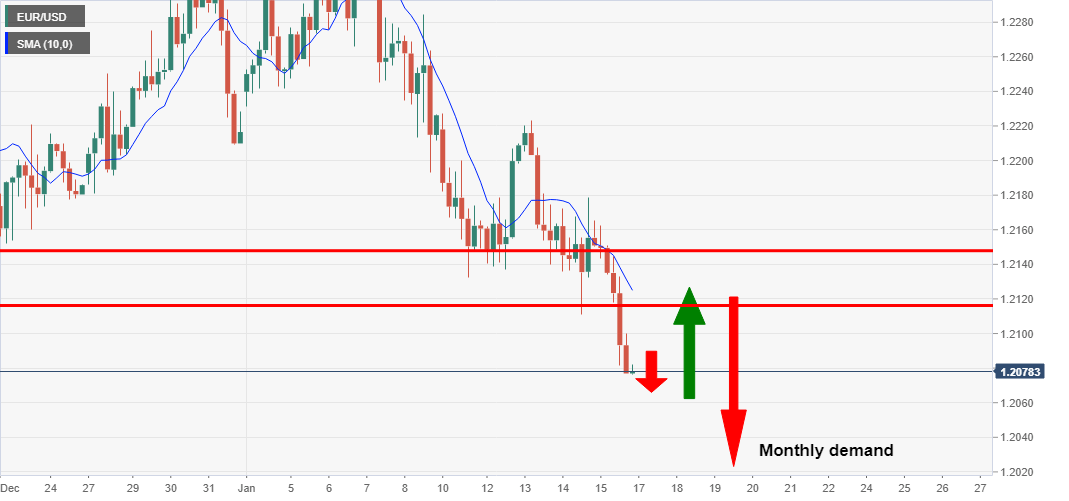

Meanwhile, the euro is also correcting, as anticipated in this week’s ”The Chart of the Week”:

EUR/USD prior analysis, 4-hour chart

Source: The Chart of the Week: EUR/USD enters the bear’s lair

As can be seen, the euro is indeed correcting the strength in the greenback.

Evidently, there is room for the US dollar to give back significant ground within its monthly correction, but the overall picture remains bullish towards at least a 38.2% Fibonacci retracement.

Consequently, while USD/JPY is struggling to break resistance, there remains a high probability that it will.

USD/JPY 4-hour chart

The yen is consolidating and so long as 103.50 holds, there is the probability of the daily continuation once the 4-hour resistance is cleared.

-637465897849686885.png)

-637465901416345628.png)