- USD/JPY bulls are lining up and awaiting bullish environment and break of 4-hour resistance.

- Market correlations add conviction to the upside bias.

USD/JPY has corrected a significant portion of the medium-term bull trend and would now be expected to move higher.

The following illustrates the bullish bias on a top-down analysis across the time frames and also used USD/CHF and CHF/JPY analysis to confirm the thesis.

Monthly chart

From a monthly perspective, the price is stalling within a downtrend and is potentially headed for a restest of prior support.

Weekly chart

The weekly chart shows the price has retested the support and is now due for a continuation to the upside.

Daily chart

The daily chart is fractal of the weekly with the price testing the support, establishing and now likely to extend the bullish trend which is typical of a W-formation.

4-hour chart

The 4-hour conditions are ripening into a bullish environment.

The price would be expected to break resistance and retest it as support before continuing higher.

USD/CHF

The yen and CHF are correlated and we have seen the horse already bolt on the USD/CHF daily chart.

The yen would be expected to follow suit and therefore be expected to enable the trader more conviction in long USD/JPY.

CHF/JPY

CHF/JPY represents the weakness in the CHF displayed on USD/CHF.

However, CHF/JPY could be on the verge of a bullish correction given the price now meets support. A pullback would typically equate to a bid in USD/JPY as the yen weakens.

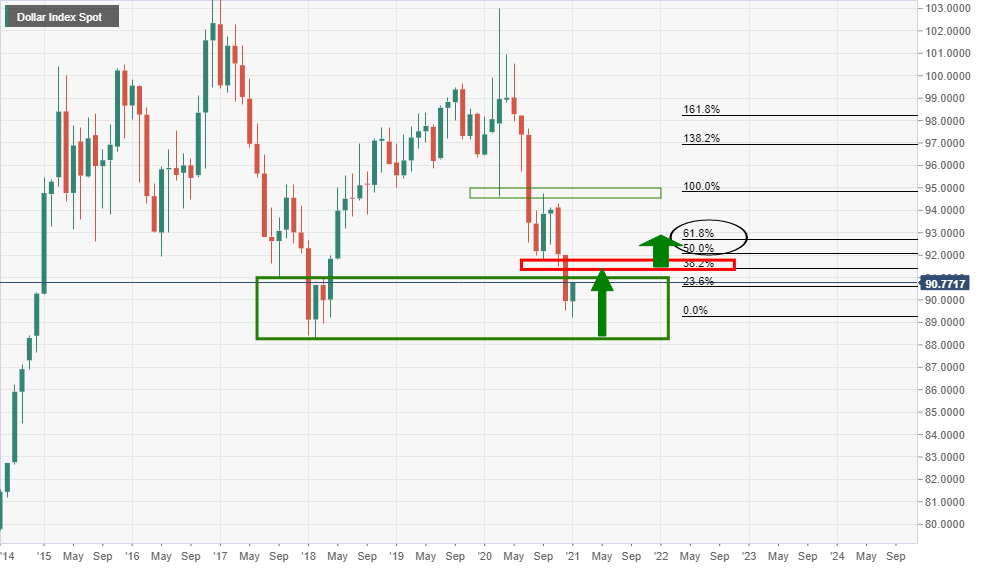

DXY monthly

The US dollar is firm and would be expected to continue higher from the lows in a correction of the monthly downtrend to at least a 38.2% Fibonacci retracement. This would bode well for USD/JPY longs.

-637465267906615418.png)

-637465268422249923.png)

-637465268845890061.png)

-637465269272420337.png)

-637465269689653318.png)

-637465270092815820.png)