- USD/JPY prints four-day winning streak, still below multiple highs marked during mid-April.

- Optimism surrounding the gradual reopening of global economies seem to favor the pair off-late.

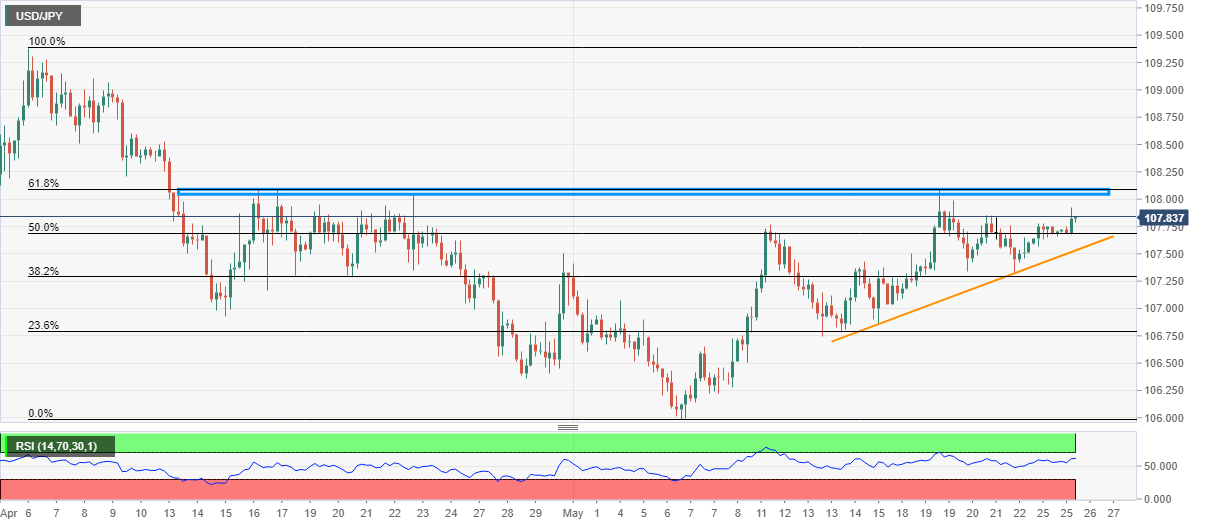

- 61.8% Fibonacci retracement adds strength to the upside barrier.

- A seven-day-old ascending trend line restricts immediate downside.

USD/JPY remains mildly bid around 107.83, up 0.11% on a day, during the pre-European session on Tuesday. In doing so, the yen pair rises for the fourth day in a row but lacks ability to cross multiple peaks registered since mid-April.

Also increasing the strength of the said resistance around 108.00/10 is the 61.8% Fibonacci retracement of the pair’s April month fall.

Though, short-term ascending trend line keeps buyers hopeful of clearing the key upside barrier and aim for April 10 top near 108.60,

During the quote’s further rise past-108.60, the previous month’s peak near 109.40 will lure the buyers.

Meanwhile, a downside break below the said support line, at 107.53 now, could recall 107.00 rest-point on the chart.

However, 23.6% Fibonacci retracement and April 29 low, respectively near 106.80 and 106.35, could please the bears during additional weakness past-107.00.

USD/JPY four-hour chart

Trend: Further recovery expected.