- The US jobs report has placed the dollar ahead of all currencies.

- Soaring imports in Japan outpaced exports in June.

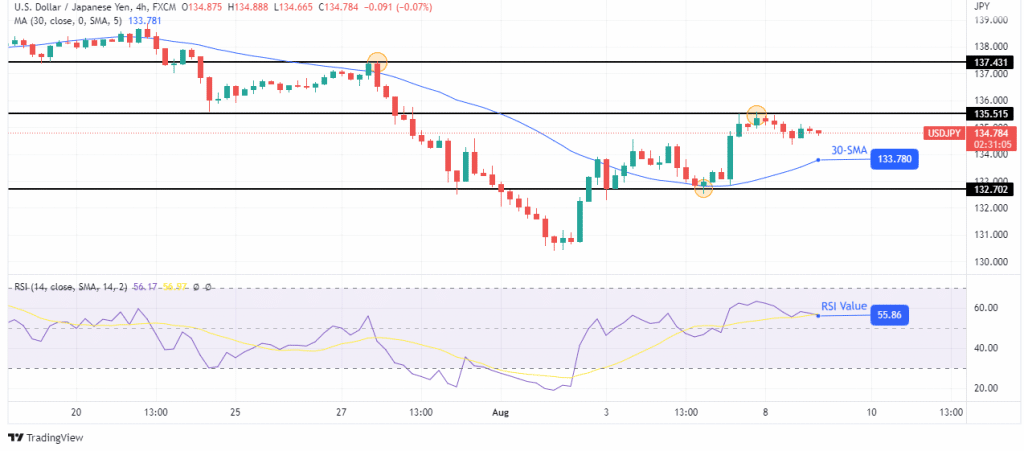

- The price is consolidating near the 30-SMA in the charts.

Today’s USD/JPY price analysis is bullish as the US dollar strengthens against most other currencies. The US dollar lost some gains after rising due to the increase in rates and employment, falling by about 0.2 percent against a basket of six major currencies to 106.4. However, analysts remain bullish on the dollar.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

“Data like this will further any thoughts about ‘US exceptionalism’ and is very positive for the USD against all currencies,” said Alan Ruskin, global head of G10 FX strategy at Deutsche Bank, referring to the US jobs report.

According to data released on Monday, Japan saw its first current account deficit in five months in June as soaring imports outpaced exports, showing the strain that rising energy and raw material prices are having on the country’s economy.

According to government data, the third-largest economy in the world experienced a current account deficit of 132.4 billion yen ($980 million) in June, a reverse of 872 billion yen from the same month a year prior. Through March 2022, the current account surplus has decreased for four consecutive fiscal years.

USD/JPY key events today

Nonfarm Productivity, which does not include the farming sector, evaluates the annualized change in labor productivity when producing goods and services. Labor-related inflation and productivity are closely associated; a decline in a worker’s productivity corresponds to an increase in their pay. Investors expect the nonfarm productivity in the US for Q2 to go up to -4.7% from -7.3%.

USD/JPY technical price analysis: Retracement to the 30-SMA support

Looking at the 4-hour chart, we see a neat uptrend that uses the 30-SMA as support. The RSI supports bullish momentum as it trades above 50. The price could not go above 135.515, which acted as strong resistance. Since then, the price has been making small-bodied candles in a sideways move as the 30-SMA catches up.

-Are you looking for the best CFD broker? Check our detailed guide-

This move is a sign that buyers are sitting on their hands, waiting to see if more buyers can come in to take the price higher. If this happens, the price will likely break above 135.515 and head for the July 27 resistance at 137.431.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.