- USD/JPY bounces off intraday low, snaps four-day uptrend.

- Easing RSI favor further consolidation of gains but 100-day SMA offers strong support.

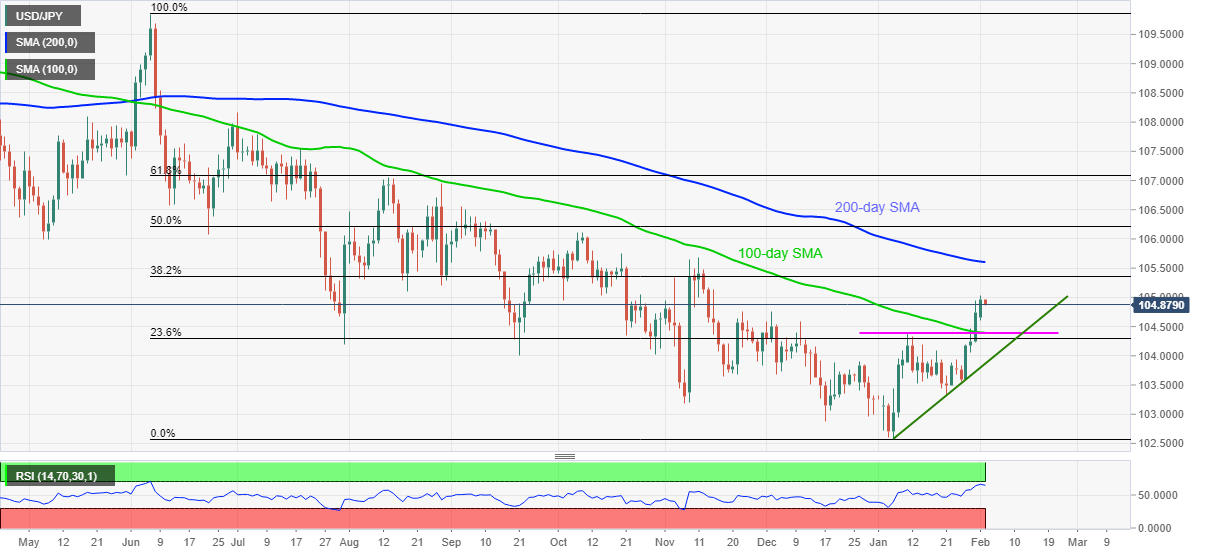

Despite the recent bounce off 104.85 to 104.90, USD/JPY prints 0.07% intraday losses, the first negative in five days, during Tuesday’s Asian trading. In doing so, the quote steps back from the highest since mid-November amid easing RSI from nearly overbought conditions.

Considering the RSI situations and the market’s latest risk-off mood, USD/JPY is likely to extend the latest pullback towards the 104.40 support confluence including 100-day SMA and the early January high.

Read: S&P 500 Futures part ways from Wall Street’s optimism as Gamestop, US stimulus gridlock probe bulls

However, an ascending trend line from January 06, at 103.86 now, will offer a tough nut to crack for USD/JPY sellers.

Meanwhile, buyers are likely to take fresh positions only if the quote crosses the latest high of 105.03.

Following that 38.2% Fibonacci retracement of June 2020 to January 2021 downside, around 105.35 and 200-day SMA near 105.60 will be the key to watch.

Overall, USD/JPY remains strong but RSI conditions favor retracement.

USD/JPY daily chart

Trend: Pullback expected