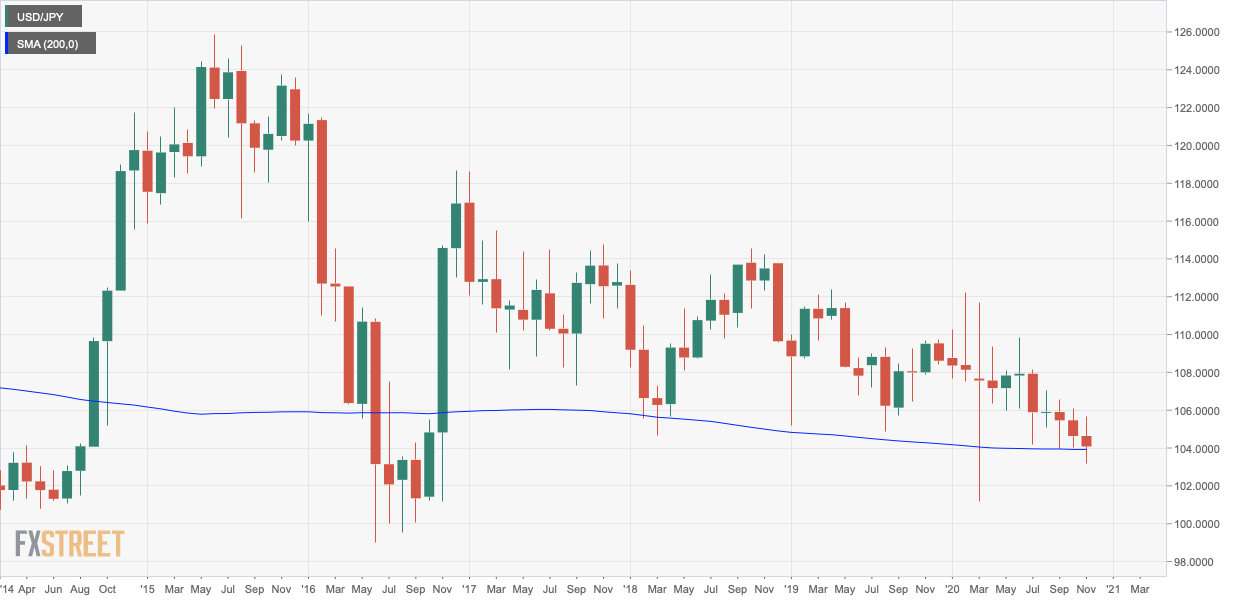

- USD/JPY trades close to a long-held 200-month SMA.

- A violation there would shift risk in favor of a drop to deeper support levels.

USD/JPY is currently trading near 104.10, representing a 0.12% drop on the day. The bears failed to establish a foothold under the 200-month Simple Moving Average (SMA) of 103.92 earlier this month.

The bears have failed several times in the past four years to force a monthly close under the long-term average.

As such, the 200-month SMA is the level to defend for the bulls. If the pair ends below that average line on Monday, more substantial selling pressure may emerge, yield a more profound drop toward 101.18 (March low).

A close above resistance at 104.76 (Nov. 24 high) would confirm a short-term bullish reversal and open the doors to 105.68 (Nov. 11 high).

Monthly chart

Trend: Bearish below 200-month MA

Technical levels