- USD/JPY refreshed multi-month tops during the early European session on Friday.

- The overnight flag breakout supports prospects for a further appreciating move.

- Overbought RSI on the daily chart warrants caution for aggressive bullish traders.

The USD/JPY pair traded with a mild positive bias through the early European session and refreshed multi-month tops, around the 109.40-45 region in the last hour.

The prevalent risk-on mood – as depicted by a positive trading sentiment around the equity markets – undermined demand for the safe-haven Japanese yen. Bulls further took cues from a modest pickup in the US Treasury bond yields, through a subdued US dollar price action seemed to cap gains for the USD/JPY pair, at least for now.

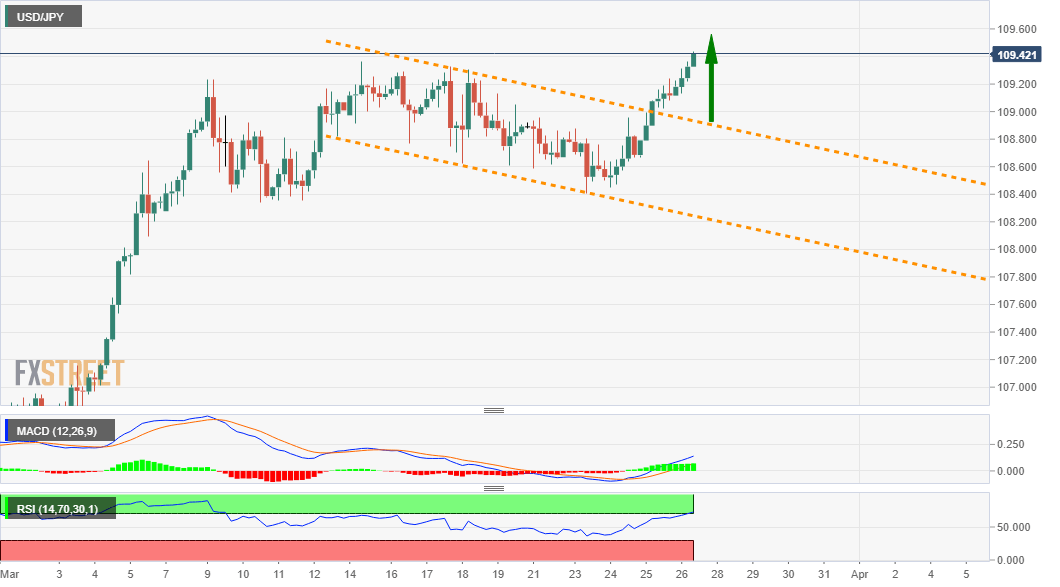

Looking at the technical picture, the USD/JPY pair on Thursday move beyond a descending channel resistance. Given the recent strong move up over the past three months or so, the mentioned channel constituted the formation of a bullish flag pattern. A sustained breakthrough has already set the stage for additional gains.

Meanwhile, RSI (14) on the daily chart is still holding above the 70.00 mark, pointing to slightly overbought conditions. This might further hold back investors and warrants some near-term consolidation. Nevertheless, the constructive set-up favours bullish traders and supports prospects for a further appreciating move.

From current levels, the next relevant hurdle on the upside is pegged near May 2020 swing highs, around the 109.80-85 region and is closely followed by the key 110.00 psychological mark. Some follow-through buying could push the USD/JPY pair beyond the 110.30 intermediate, towards the 110.75-80 supply zone.

On the flip side, the descending channel resistance breakpoint, currently near the 109.00 mark now seems to protect the immediate downside. Any subsequent slide is likely to find decent support and might be seen as a buying opportunity near the 108.60-55 region. This should now act as a strong near-term base for the USD/JPY pair.

USD/JPY 4-hourly chart

Technical levels to watch