- Fed Chair Powell failed to provide any new indications of a hawkish pushback.

- Japan’s current account surplus sharply declined in December.

- Current account surpluses have been a source of confidence in the safe-haven yen.

Today’s USD/JPY price analysis is bullish. According to data from the finance ministry on Wednesday, Japan’s current account surplus sharply declined in December following a record rise the previous month.

-If you are interested in forex demo accounts, check our detailed guide-

This shows the impact of ongoing trade deficits and a depreciating yen on the nation’s formerly stable balance of payments.

Japan’s entire current and trade accounts are under great strain due to the yen’s decline over the past year. It has increased the cost of imports such as commodities and oil that were already rising in price owing to the Ukraine war.

The current account surplus was 33.4 billion yen ($255.51 million) in December, significantly decreasing from the 1.8 trillion yen surplus in November.

The current account has occasionally gone negative on a monthly basis in recent years, in part because a weaker yen has increased the cost of imports. Historically, current account surpluses have been seen as a sign of export strength and a source of confidence in the safe-haven yen.

Some analysts predict that by the end of this year, Japan’s balance of payments situation will improve as the downward pressure on the yen eases in conjunction with a predicted pause in the Fed’s monetary tightening campaign.

The dollar fell on Wednesday capping the pairs gains as investors wagered that interest rates might not climb significantly more. Federal Reserve Chair Jerome Powell failed to provide any new indications of a hawkish pushback against the country’s robust labor market.

USD/JPY key events today

There won’t be any significant news releases from Japan or the US today, so the pair will probably consolidate.

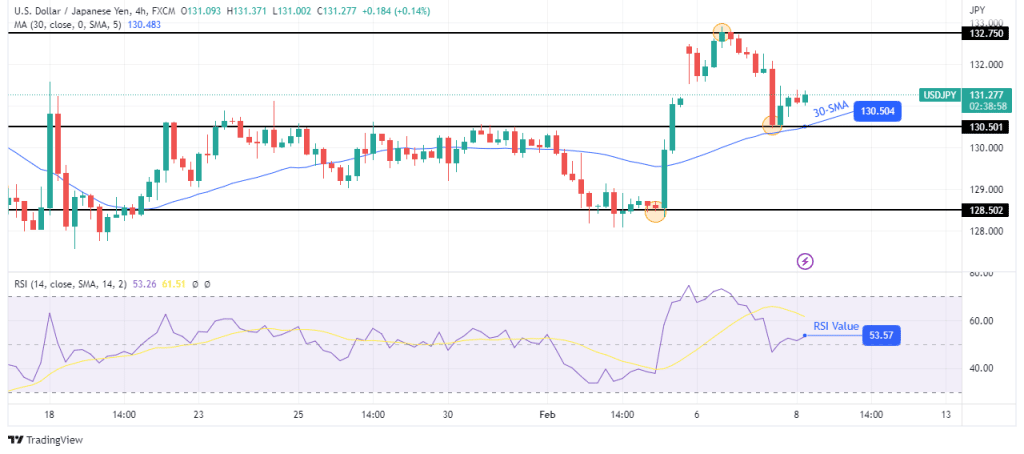

USD/JPY technical price analysis: Strong moves from both bears and bulls

The 4-hour chart shows USD/JPY trading above the 30-SMA and the RSI slightly above 50, indicating that bulls are ahead. However, a closer look at the candles shows that both bulls and bears are making sharp impulsive moves that could mean equal strength.

-If you are interested in Islamic forex brokers, check our detailed guide-

If this is the case, the price might be consolidating with the 132.75 level as resistance and the 128.50 level as support. The price might therefore break below the 30-SMA and head for the 128.50 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.