- A combination of factors assisted USD/JPY to gain some positive traction on Friday.

- A softer USD held bulls from placing aggressive bets and capped gains for the pair.

- Acceptance below the 109.00 mark might have set the stage for further weakness.

The USD/JPY pair traded with a mild positive bias through the early North American session, albeit lacked any follow-through and remained capped below the 109.00 level.

The prevalent risk-on environment undermined demand for the safe-haven Japanese yen. Bulls further took cues from a solid rebound in the US Treasury bond yields. That said, a softer tone surrounding the US dollar capped the upside for the USD/JPY pair.

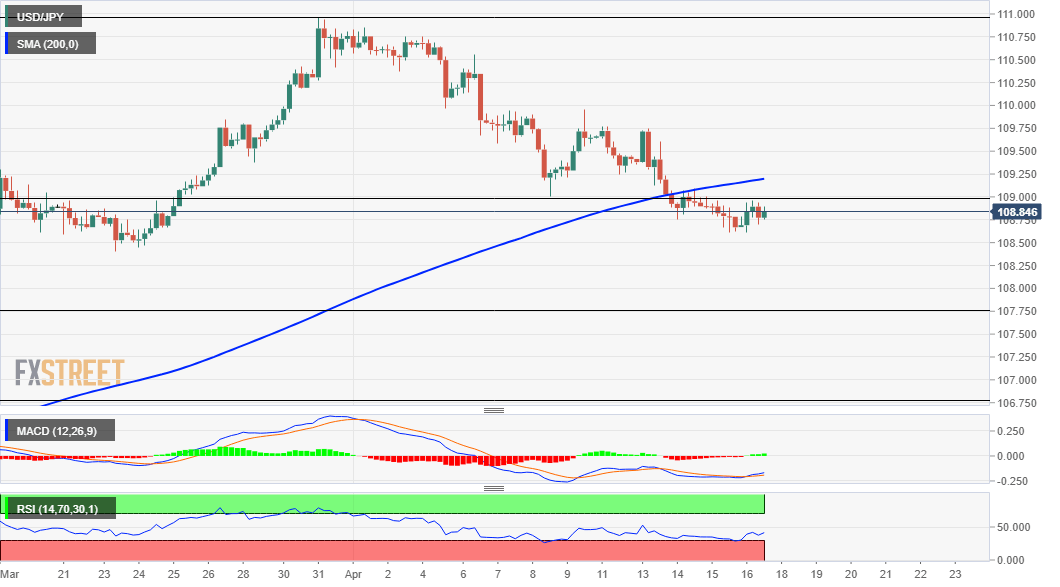

From a technical perspective, the 109.00 handle marks a confluence support breakpoint comprising of 200-period SMA on the 4-hour chart and the 23.6% Fibonacci level of the 102.59-110.97 strong move up. This should now act as a pivotal point for traders.

Meanwhile, technical indicators on the 4-hour chart maintained their bearish bias and have just started drifting into the negative territory on the daily chart. The set-up supports prospects for an extension of the recent pullback from one-year tops.

From current levels, immediate support is pegged near the 108.35 horizontal level. Some follow-through selling should pave the way for a slide towards challenging the 108.00 round-figure mark, en-route the 38.2% Fibo. level support, around the 107.75 region.

On the flip side, sustained move beyond the 109.00 mark might prompt some short-covering move. The USD/JPY pair might then climb to the 109.35-40 intermediate resistance before bulls eventually aim back to reclaim the key 110.00 psychological mark.

USD/JPY 4-hour chart

Technical levels to watch