- USD/JPY bulls catch a breather near eight-month high.

- Multiple tops marked since mid-April challenge further upside.

- Bears have multiple barriers to tackle before entry.

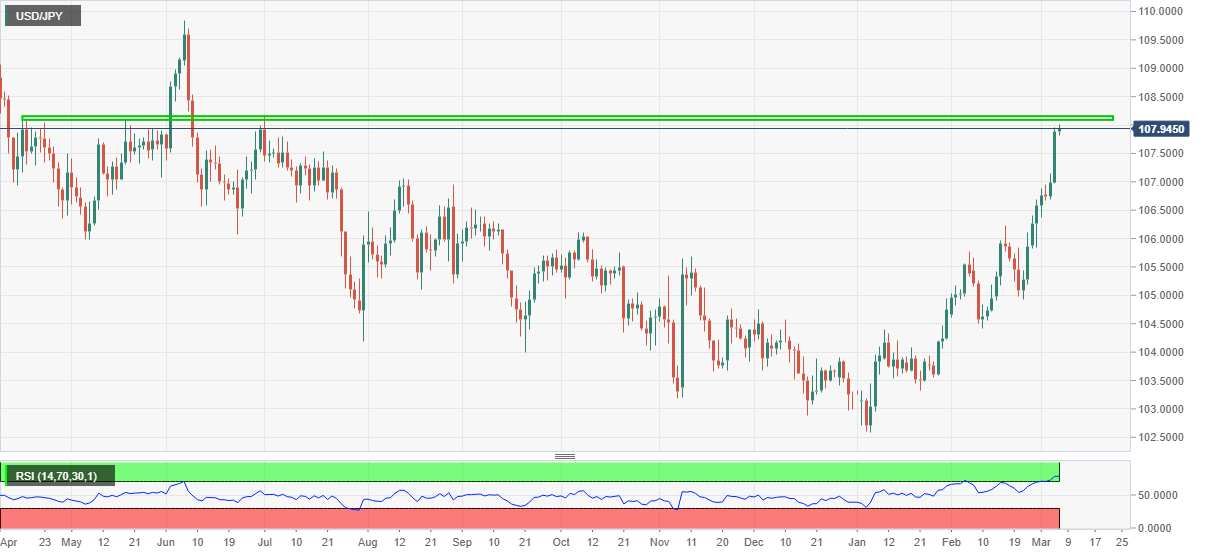

USD/JPY wavers around the multi-month top, marked initially in Asia, while taking rounds to 108.00 during early Friday. In doing so, the yen pair consolidates the heaviest gains in two months amid overbought RSI conditions.

Also challenging the pair’s further upside could be an area surrounding 108.10-15 comprising multiple tops marked in April, May and July of 2020.

Considering the nearness to the key US employment data, the odds of a cautious move after a heavy run-up can’t be ruled out.

Read: Nonfarm Payrolls Preview: Dollar booster? Three expectation downers pave way for upside surprise

However, late-July tops near 107.55 and August month’s peak close to 107.00 will question the short-term USD/JPY sellers.

If at all the quote manages to stay below 107.00, February 17, 2021 top near 106.20 should return to the charts.

Alternatively, an upside break of 108.15 will eye for the 109.00 threshold and June 2020 high of 109.85 before directing USD/JPY bulls to the 110.00 round-figure.

USD/JPY daily chart

Trend: Pullback expected