- USD/JPY extends previous day’s recovery moves from one-week low.

- 50% Fibonacci retracement, falling trend line from February 17 offers extra hurdle.

- Easing RSI line, failures to cross strong resistances keep sellers hopeful.

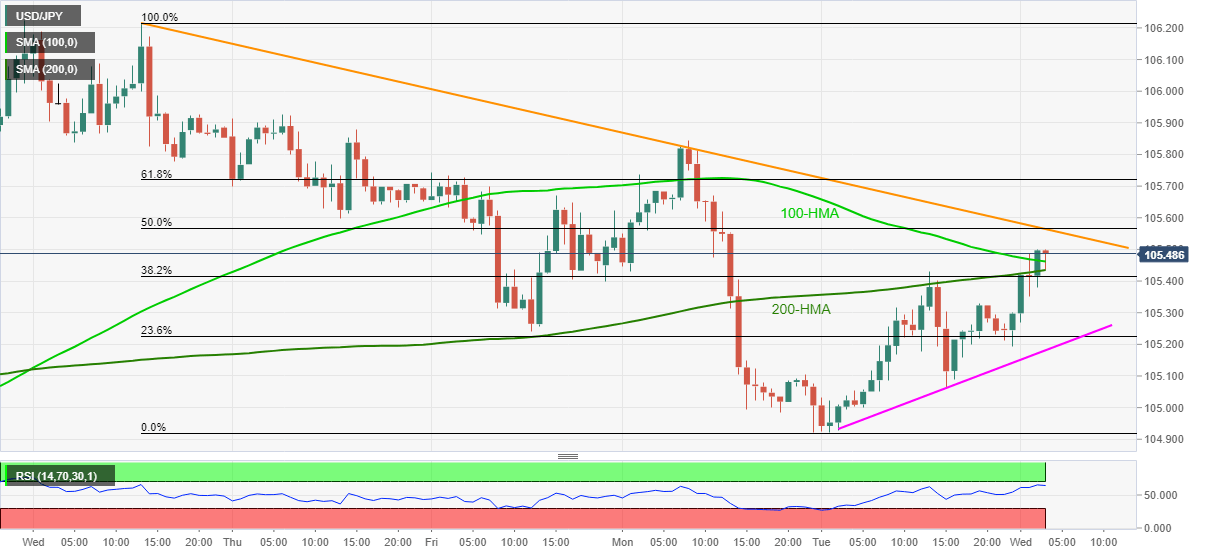

USD/JPY eases from intraday top of 105.50 to 105.45, up 0.18% intraday, during early Wednesday. In doing so, the yen pair keeps Tuesday’s recovery moves from the lowest since February 15 while struggling to overcome the confluence of 200 and 100-HMAs.

Considering the nearly overbought RSI, stepping back recently, the yen pair may fail to cross the resistance confluence near 105.40-45. However, a convergence of a one-week-old descending trend line and 50% Fibonacci retracement of February 17-22 drop, near 105.60, will offer extra filters to the north.

In a case where the USD/JPY bulls manage to cross 105.60, 61.8% Fibonacci retracement level and Monday’s high, respectively around 105.70 and 105.85, will be their stops ahead of eyeing the monthly high of 106.22.

Meanwhile, the weekly support line, currently around 105.20, can offer immediate rest to the quote during the pullback moves.

Though, any further weakness below 105.20 will easily refresh the monthly low of 104.92 while also catching a breather around 105.00.

USD/JPY four-hour chart

Trend: Pullback expected