- USD/JPY holds onto recovery gains from Tuesday’s low near 106.00.

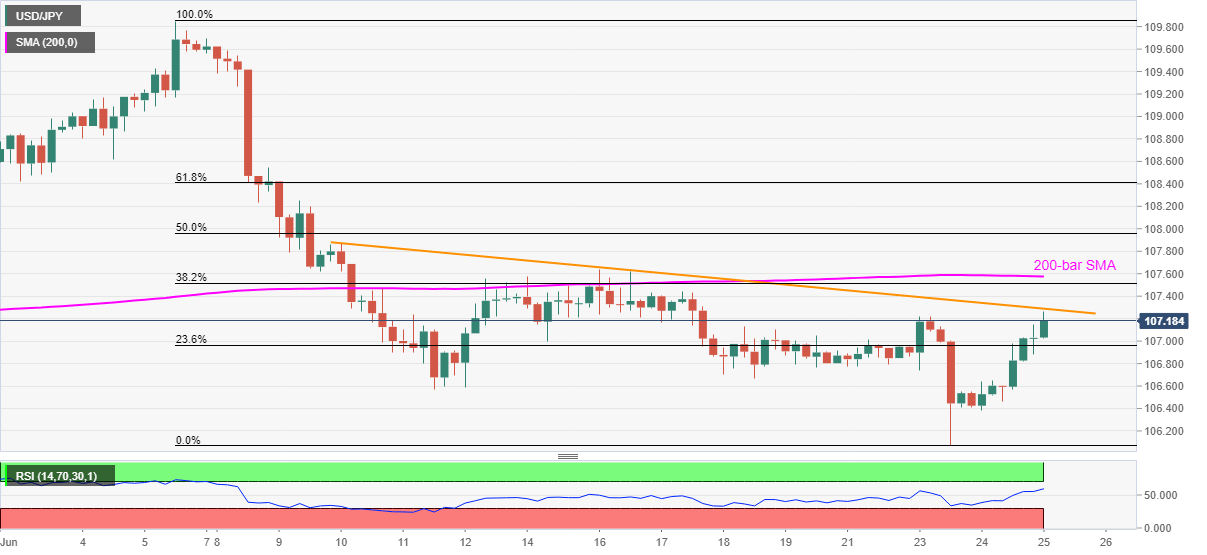

- A two-week-old falling trend line, 200-bar SMA question the buyers.

- Sellers will wait for a clear break below 106.40 for fresh entries.

USD/JPY seesaws around the 107.20, near the recently flashed intraday high of 107.26, amid the initial trading on Thursday. In doing so, the yen pair takes the bids near the one-week high while also saying below a falling trend line since June 10.

Considering the recent pullback, supported by strong RSI conditions, the quote is likely to extend the rise towards breaking the immediate resistance line around 107.30. However, 200-bar SMA close to 107.60 might question an additional upside.

In a case where the bulls dominate past-107.60, June 09 high of 108.25 and 61.8% Fibonacci retracement of June 05-23 fall, adjacent to 108.40 will be on their radars.

Alternatively, 106.75 and 106.40 might entertain sellers during the fresh declines ahead of the monthly low at 106.08. Though, the pair’s additional weakness below 106.00, also breaking the May month low of 105.99, could recall 105.00 mark on the charts.

USD/JPY four-hour chart

Trend: Further recovery expected