- Major US banks intervened on Thursday to save First Republic Bank.

- Traders flocked to the yen, which is regarded as a haven.

- Japan reported export gains in February for the second year in a row.

Today’s USD/JPY price analysis is tilted to the downside as the improved risk sentiment weighs on the US dollar, resulting in reduced pressure on the major markets.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Major US banks intervened on Thursday to save First Republic Bank by injecting $30 billion in deposits into the institution. First Republic Bank was immersed in a growing crisis brought on by the failure of two other mid-sized US banks last week.

Top decision-makers from the US Treasury, Federal Reserve, and banks developed the $30 billion rescue plan. This was after Credit Suisse said earlier on Thursday that it would borrow up to $54 billion from the Swiss National Bank.

Traders flocked to the yen, which is typically considered a safer alternative during turmoil. There was fear that the current stress spreading across banks in the US and Europe may merely be the beginning of a global systemic crisis.

Japan reported export gains in February for the second year in a row due to strong exports of vehicles to the United States. However, hopes of a substantial recovery of demand are swiftly fading due to global monetary tightening and worries about banks worldwide.

The focus now shifts to next week’s Federal Reserve’s monetary policy meeting. Some investors expect the Fed to scale back its brisk rate-hike campaign to reduce the strain on the financial industry.

USD/JPY key events today

Investors are not expecting significant economic releases from the US or Japan. Therefore, they will focus on macroeconomic events.

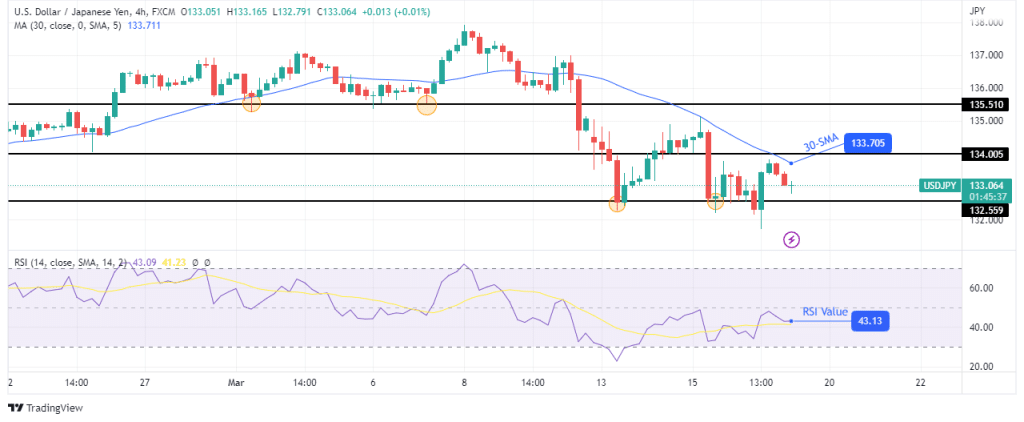

USD/JPY technical price analysis: Bearish trend respects the 30-SMA resistance

The 4-hour chart shows USD/JPY in a bearish trend, with the price making lower highs and lows. The price also respected the 30-SMA as resistance and bounced lower when it got to the SMA. Currently, the price is reacting to the SMA and might bounce lower again.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

If bears get stronger, we might see the price taking out the 132.55 support to make a new low. However, if it breaks above the SMA and 134.00 resistance, it will likely climb to 135.51.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money