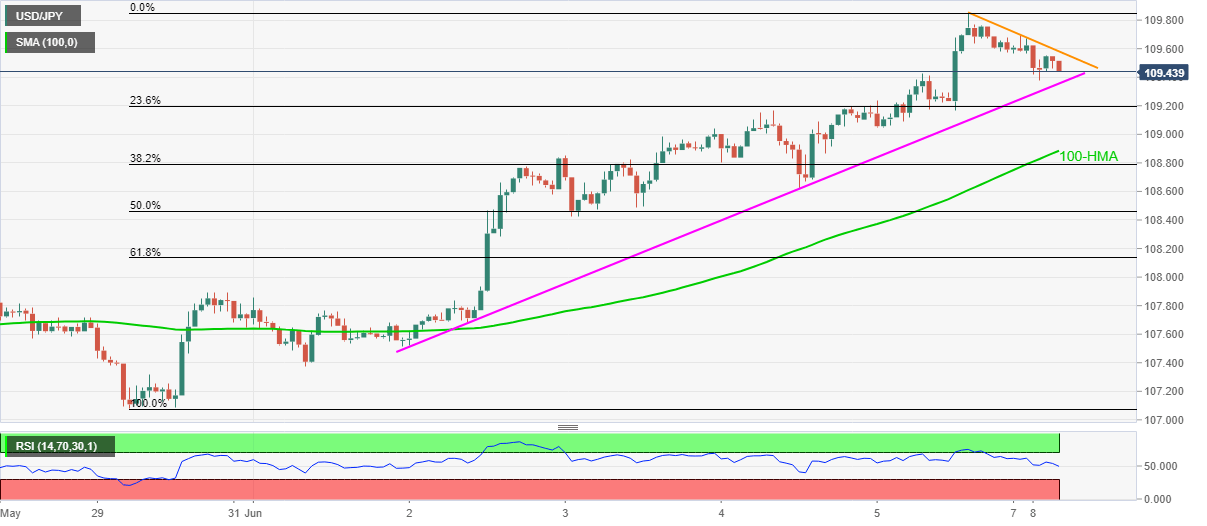

- USD/JPY snaps four-day winning streak while declining from 109.70.

- An ascending trend line from June 02, 100-HMA lure the sellers.

- Bulls may wait for a sustained break above 110.00 for fresh entries.

USD/JPY steps back from 10-week high while declining to 109.47, down 0.12% on a day, during the pre-European session on Monday.

Even so, the yen pair stays above a short-term support line as well as 100-HMA amid mostly normal RSI conditions, which in turn keep buyers hopeful.

However, the quote’s downside below the said support line of 109.35 can fetch it to 108.89, comprising 100-HMA, without delay.

If at all the USD/JPY prices slip below 108.89, June 03 low around 108.40 might offer an intermediate halt before dragging the pair to the late-May top near 107.90.

Meanwhile, an immediate falling trend line surrounding 109.60 can act as a nearby upside barrier ahead of 110.00 round-figure.

Should the bulls manage to conquer 110.00 on a daily closing basis, 111.00 and March month high near 111.72 can return to the charts.

USD/JPY hourly chart

Trend: Bullish