- It was a strong week for USD/JPY, with a gain of 1.29%.

- The dollar rises due to Russian-Ukrainian skirmishes, Fed speeches, and expectations of a rate hike by the Federal Reserve.

- According to STIR, the probability of a 50-bps rate hike by the Fed is 94%.

As the London session begins, the USD/JPY price is barely gaining on the day, and its rally is set to last for two straight days, supported by a strong US Dollar, strong US Treasury yields, and risk-averse market sentiment. USD/JPY is currently trading at 126.45, up 0.45% at the time of writing.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

Greenback roars

The US stock market finished the week lower as traders braced for the weekend, while benchmark 10-year bonds rose 12.5 basis points to 2.827%, supporting the greenback. The US Dollar Index, which tracks the dollar’s value against a basket of currencies, climbed 0.46% to 101.35.

The dollar rose on Thursday on the back of geopolitical turmoil, rising global inflation, Fed speeches, and expectations of a 50 basis point rate hike at its meeting in May.

Russia-Ukraine clinging tension

It seems unlikely that a ceasefire will be reached between the Russians and Ukrainians. Although the Ukrainian foreign minister said negotiations continued online, no progress had been made. Russian defense minister stated that the Moskva, their flagship ship, had sunk, meaning that the escalation has continued. According to reports from the Russian side, Ukraine had launched a missile attack on a Russian warship in the Black Sea.

Fed’s 50-bps rate hike

Along with geopolitical issues, John C. Williams, President of the New York Fed, delivered speeches throughout the day. In May, a rate hike of 50 basis points is a “smart” option, but its pace will depend on the economy. Williams reiterated what Fed Chair Brainard had previously said about the need for the Fed to move to more normal and above neutral monetary policy levels as soon as possible.

Additionally, according to money market futures, a 50-basis point hike in the Federal Funds Rate (FFR) is 94 percent likely at the next FOMC meeting, based on short-term interest rates (STIR).

What’s next to watch for USD/JPY price?

Because of Good Friday, Japan and the US economic dockets are blank today. However, the next week will be decisive for the pair. So, keep an eye on US yields and statements from the central banks’ policymakers.

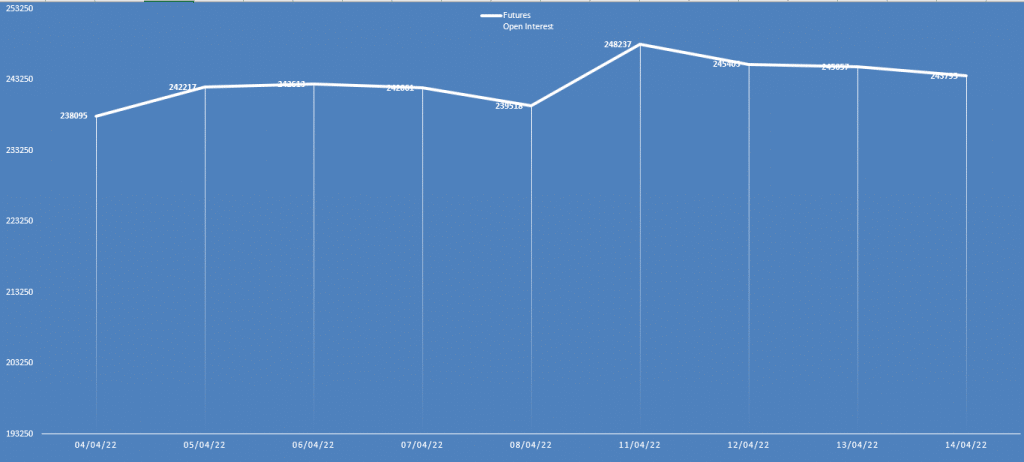

USD/JPY daily open interest and price analysis

The USD/JPY price is rising while the daily open interest is slowly declining. It shows that the upside bias is losing momentum. However, this is not an indicator of a bearish trend reversal.

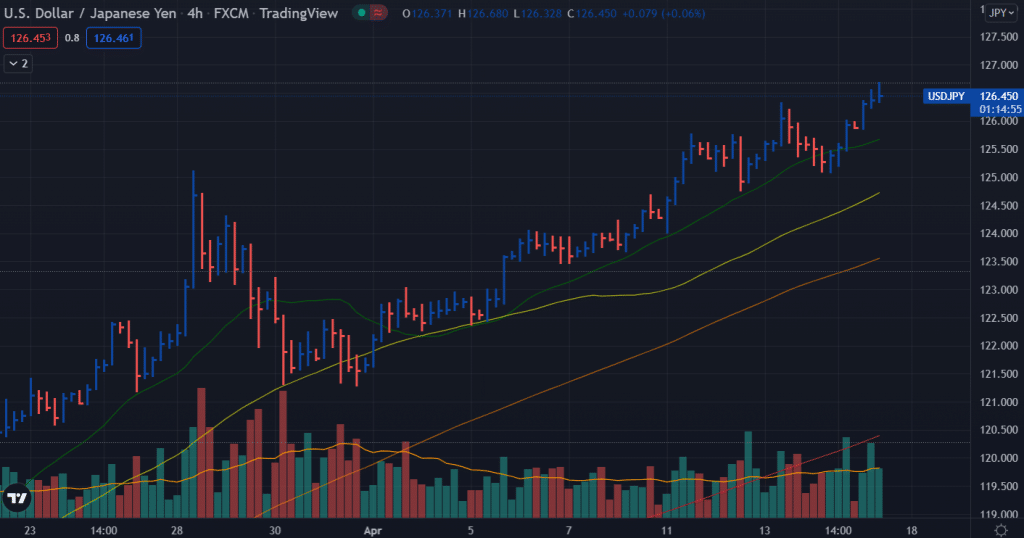

USD/JPY price technical analysis: Bulls rock above 126.00

The USD/JPY price soars above the 126.00 figure, hitting a high of 126.70. The price lies well above the key SMAs on the 4-hour chart. However, a very high volume with a narrow bar tells us about the potential exhaustion of an uptrend. However, this needs to be confirmed by subsequent price action next week.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money