- The USD/JPY pair is bearish if it stays under the downtrend line.

- Taking out the support levels announces more declines.

- The US data could be decisive during the week.

The USD/JPY price extended its sell-off and is now trading at 137.80 at the time of writing. The pair dropped as low as 137.49 on the day.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

The downside pressure remains high as the US dollar is in a corrective phase while Yen has gained across the board.

Fundamentally, the Japanese economic data came in mixed on Friday. Tokyo Core CPI rose by 3.6% versus the expected 3.5%, compared to 3.4% in the previous reporting period, while SPPI surged only by 1.8% less versus the 2.1% growth estimate.

Today, the FOMC members Williams and Bullard’s speeches could bring more action. Tomorrow, Japan is to release the Unemployment Rate, which could drop from 2.6% to 2.5%, and the Retail Sales. The economic indicator could report a 5.0% growth.

On the other hand, the US CB Consumer Confidence may drop from 102.5 points to 100.0 points. The US economic data could be decisive during the week. The Prelim GDP, ADP Non-Farm Employment Change, JOLTS Job Openings, Core PCE Price Index, ISM Manufacturing PMI, Average Hourly Earnings, Unemployment Rate, and the NFP data will be released as well.

USD/JPY price technical analysis: Strong selling momentum

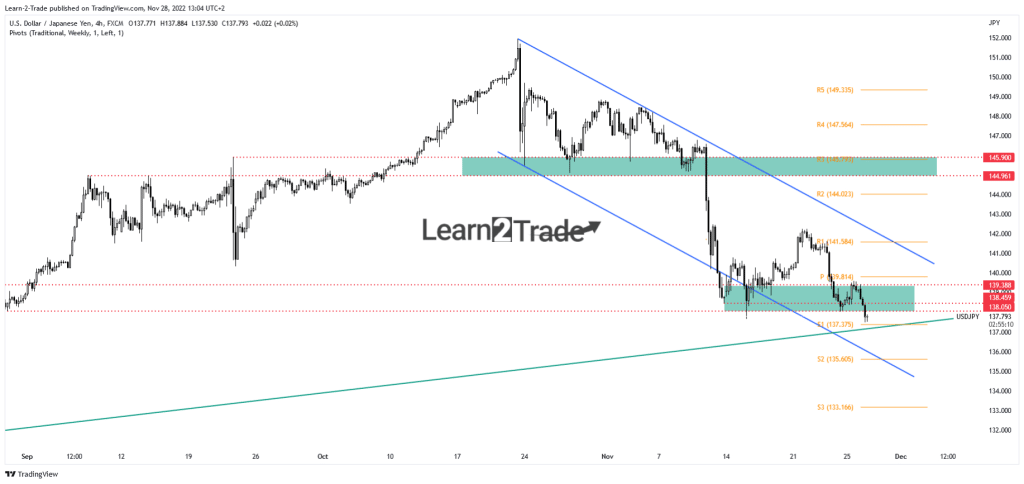

Technically, the currency pair rebounded in the short term after failing to stabilize under the channel’s down trendline. Still, the throwback ended, dropping below 138.05 static support.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

The pressure remains high as long as it stays below 138.45 and under 139.38. The S1 (137.37) and the ascending trendline represent near-term downside obstacles. Taking out these levels may announce more declines.

After its strong drop, the price could come back to retest the immediate resistance levels before dropping deeper. The descending trendline represents a major dynamic resistance. It could approach new lows as long as it stays below this line.

Though, it remains to see how it reacts around the uptrend line. False breakdowns may indicate exhausted sellers and new bullish momentum.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.