- The USD/JPY pair maintains a bullish bias after failing to retest the immediate support levels.

- A valid breakout above the warning line (wl1) may confirm an upside continuation.

- False breakouts above the near-term resistance levels could announce that the leg higher is over.

The USD/JPY price rallies at the time of writing. The USD was lifted by the DXY’s rebound, while the Yen was weakened by the Japanese Yen futures sell-off.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The bias is bullish, so further rise is possible. However, it challenges the 119.00 psychological level, representing an upside obstacle. In the short term, it has retreated, but the correction was temporary. As long as the Dollar Index grows and the Yen futures drop deeper, the USD/JPY pair is expected to approach fresh highs. The Japanese Yen is strongly bearish. It has dropped against all its rivals.

Today, the Bank of Japan left its monetary policy unchanged. The BOJ Policy Rate remains at -0.10% as expected. The Yen remains weak as the BOJ reiterated that they will add more easing measures if needed. Moreover, the National Core CPI rose by 0.6%, matching expectations, while the Tertiary Industry Activity dropped by 0.7% less versus 1.0% drop estimated.

Later, the US CB Leading Index is expected to report a 0.3% growth, while the Existing Home Sales could come in at 6.10M in February, below 6.50M in January.

USD/JPY price technical analysis: Uptrend to continue

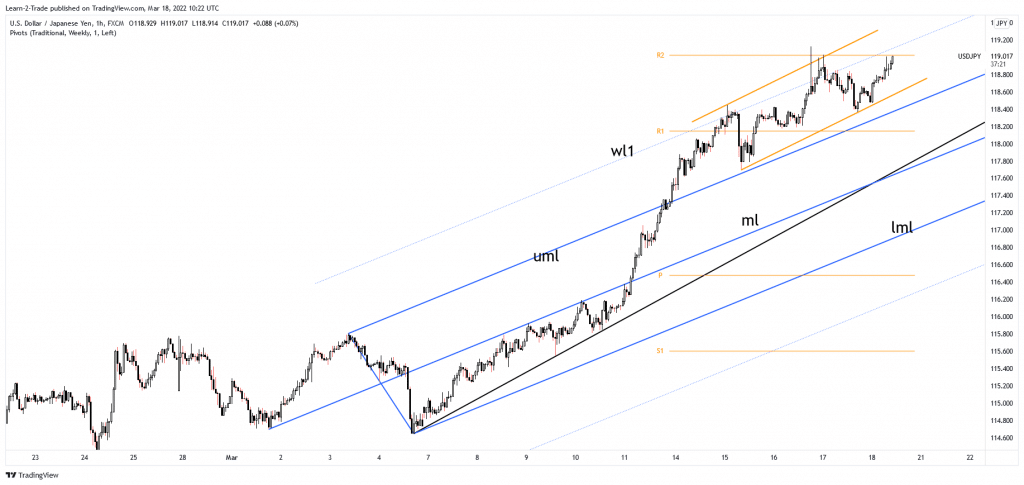

The USD/JPY pair is trapped within a minor up channel. In the last attempts to signal strong buyers, it failed to test and retest the weekly R1 (118.14) and the ascending pitchfork’s upper median line (UML). Now, it challenges the weekly R2 (119.02), which stands as an upside obstacle, as a static resistance.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The bias remains bullish as long it stays above the minor uptrend line and above the upper median line (UML). It remains to see how it will react after reaching the first warning line (wl1). The rate registered only false breakouts above this line, confirming a dynamic obstacle. A valid breakout above it and through the R1 may announce an upside continuation. On the contrary, false breakouts could announce that the leg higher is over, and we may have a corrective phase.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money