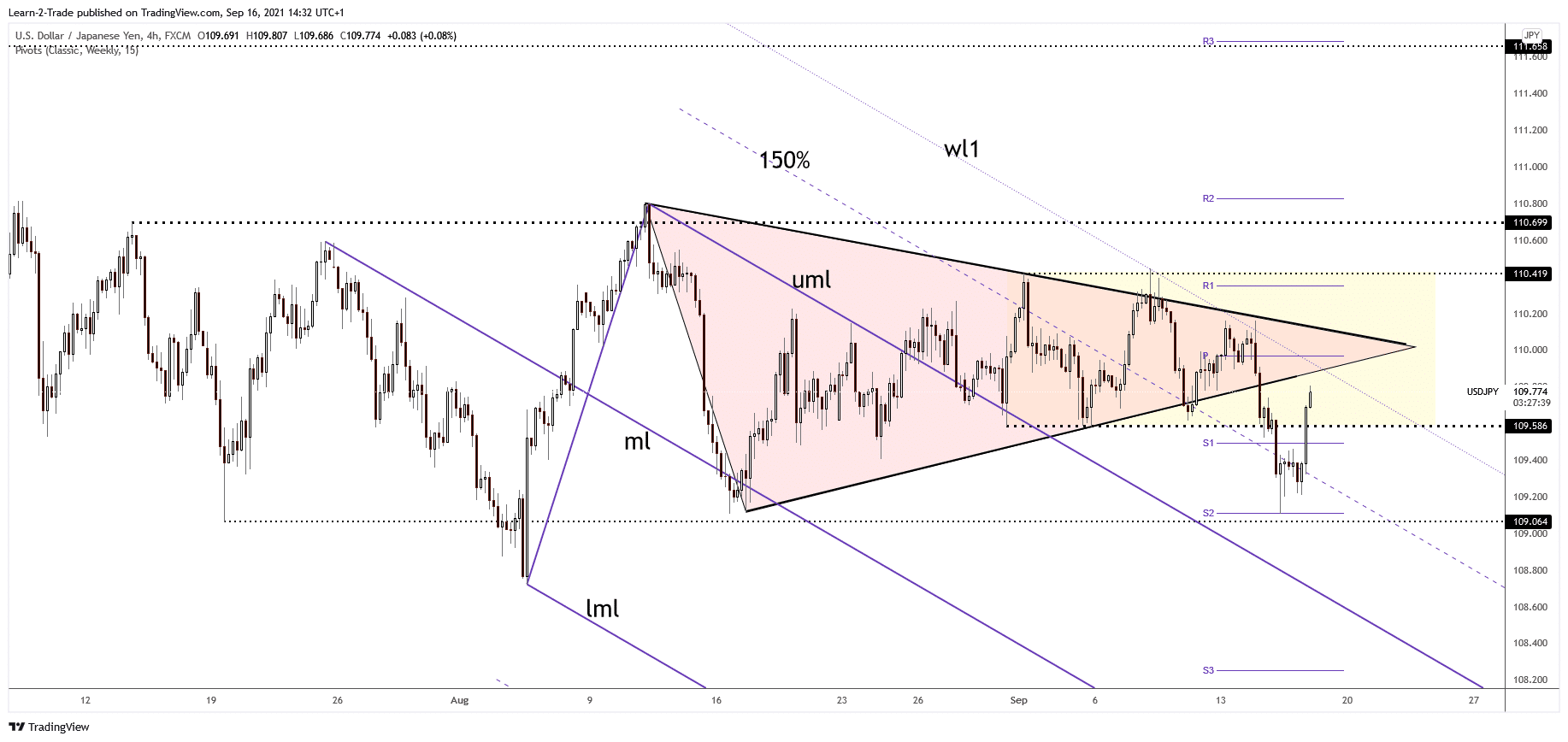

- The USD/JPY rebounded as the DXY rallied after positive US data.

- The pair could develop a larger upwards movement only after taking out the warning line (wl1).

- A new lower low could activate a broader leg down.

The USD/JPY price rebounded from 109.11 yesterday’s low and now is traded at 109.78 level. The pair has rallied as the Dollar Index has registered a strong bullish momentum, while the JP225 (Nikkei) stays higher. Unfortunately, we don’t have a clear direction in USD/JPY at this moment.

-Are you looking for automated trading? Check our detailed guide-

The pair is still trapped within a key ranging pattern, so only a valid breakout from this formation could bring fresh trading opportunities. The Japanese Yen was punished by the Japanese Trade Balance, reported lower at -0.27T versus 0.10T expected. As you already know, the USD/JPY was boosted by better-than-expected US retail sales data.

Retail Sales registered a 0.7% growth versus 0.7% drop forecasted and after a 1.8% drop registered in July, while the Core Retail Sales rose by 1.8% compared to 0.1% decline expected and versus the 1.0% drop registered in July. Tomorrow, the US Prelim UoM Consumer Sentiment could help the USD to resume its appreciation.

USD/JPY price technical analysis: Key ranging behavior

The USD/JPY pair found strong demand on the weekly S2 (109.11) and now is traded at 109.66 below 109.82 today’s high. However, it’s still trapped between 109.06 and 110.69 levels. Only a valid breakout from this pattern could bring new short or long opportunities.

-If you are interested in forex day trading then have a read of our guide to getting started-

The pair dropped after escaping from the triangle pattern. The USD/JPY pair has registered an aggressive breakdown through 109.58 static support, but it has failed to reach the 109.06 downside obstacle. Technically, the price has escaped from a descending pitchfork, signaling potential growth. The first warning line (wl1) is seen as a dynamic resistance. Making a valid breakout through it could announce a potential further growth.

As long as the price stays below it, the USD/JPY pair will likely remain under massive selling pressure. A new lower low could really activate a larger downside movement. On the other hand, the Dollar Index is bullish, so further growth could help the USD resume its appreciation.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.