- The bias remains bullish as long as it stays above the uptrend line.

- A new higher high activates an upside continuation.

- The US data could be decisive during the week.

The USD/JPY price retreated after reaching today’s high at 145.86. Now, the pair is trading at 145.65 at the time of writing. The bias remains bullish despite minor retreats.

-If you are interested in forex day trading then have a read of our guide to getting started-

As you already know, the USD is bullish as the FED hiked rates. Markets expect an increase in the Federal Funds Rate in the next monetary policy meetings. On the other hand, the BOJ left its monetary policy unchanged. The USD/JPY pair registered a temporary sell-off on September 22, 2022, after the BOJ intervened in the FX market.

Fundamentally, the Japanese economic data came in mixed. The Current Account was reported at -0.53T versus -0.56T expected and -0.63T in the previous reporting period. In contrast, Economy Watchers Sentiment was reported at 48.4 points versus 47.6 points expected and far above 45.5 in the previous reporting period.

Later, the US is to release the NFIB Small Business Index and the IBD/TIPP Economic Optimism. However, I don’t think that will change the sentiment. FOMC member Mester Speaks could have an impact.

Tomorrow, the US PPI and the FOMC Meeting Minutes could shake the markets and bring high action in USD/JPY. Also, don’t forget that the US inflation data and retail sales will move the markets at the end of the week.

USD/JPY price technical analysis: Uptrend

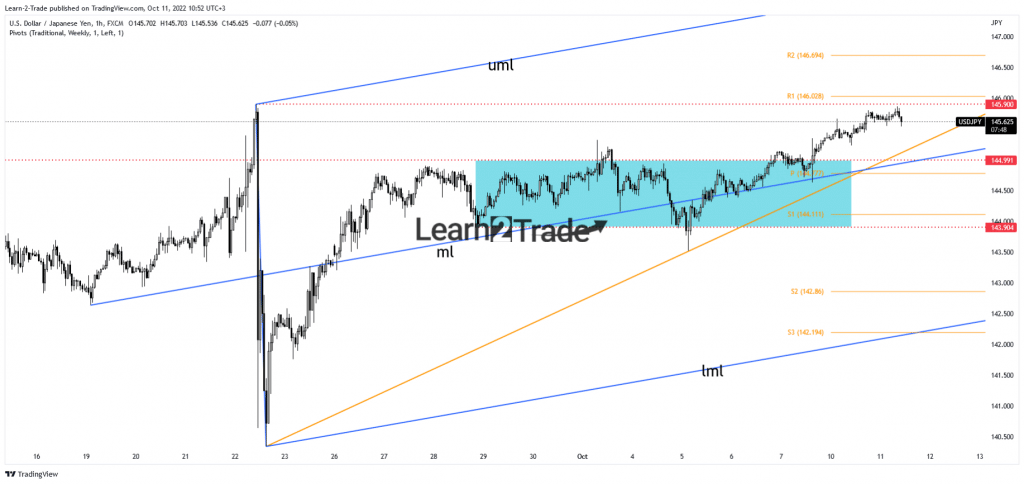

From the technical point of view, the price may resume its uptrend as long as it stays above the ascending trendline, which stands as a dynamic support. The 144.99 and median line (ml) of the ascending pitchfork also represent the support level.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

On the other hand, the 145.90 former high is seen as a major resistance. Temporary retreats are natural after its strong growth. A valid breakout above 145.90 activates an upside continuation and could bring new long opportunities. As long as it stays above the median line (ml), the rate could be attracted by the upper median line (UML), representing an upside target and obstacle.

The price resumed its growth also because the Yen Futures dropped.

Only a valid breakdown below 144.99 and under the median line could invalidate an upside continuation and bring short opportunities. Still, this scenario is less likely to happen as the upside pressure is strong.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.