- The USD/JPY pair maintains a bearish bias if it stays under the downtrend line.

- A new lower low activates more declines.

- US Core PCE data may provide fresh stimulus to the pair.

The USD/JPY price moves somehow sideways in the short term. The current range could represent a distribution pattern as the bias remains bearish in the short term. Now, the price is trying to rebound as the Dollar Index bounced back because the Japanese Yen Futures dropped a little. It was traded at 127.14 at the time of writing, and it extended its range after failing to approach and reach the immediate lows.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

Fundamentally, the USD was punished by the US Prelim GDP in yesterday’s session. The indicator reported a 1.5% drop versus only 1.3% expected. Today, Tokyo Core CPI surged by 1.9% less versus 2.0% estimates.

Later, the US is to release significant economic figures, so the fundamentals could drive the markets. The Core PCE Price Index may report a 0.3% growth, Goods Trade Balance is expected at -114.8B, while the Revised UoM Consumer Sentiment could remain steady at 59.1.

Furthermore, Personal Income, Personal Spending, and the Prelim Wholesale Inventories indicators will be released. Worse than expected, US data could push the DXY lower. This scenario indicates more declines in the USD/JPY pair.

USD/JPY price technical analysis: Correcting lower

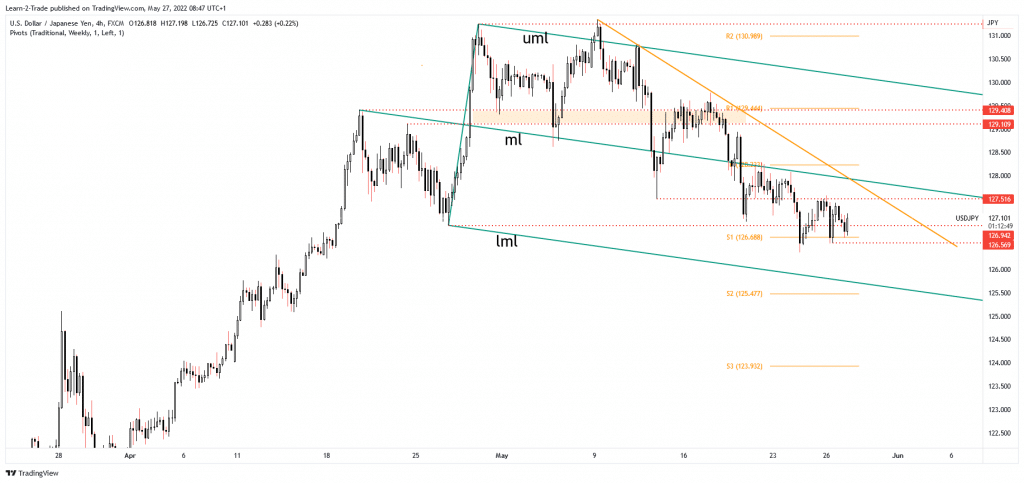

The USD/JPY pair found support on the weekly S1 (126.68), and now it is trying to rebound. The bias remains bearish as long as it stays below the downtrend line. Validating its breakdown below the median line (ml) signaled more declines and a larger corrective phase. Technically, after its previous swing, a temporary drop was expected and natural.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

The 126.94 former low stands as a downside obstacle. As you can see on the 4-hour chart, the price registered only false breakdowns. Still, 127.51 represents the near-term static resistance levels. The USD/JPY pair could slip lower. Actually, only a new lower low, a valid breakdown below 126.56, may activate a potential drop towards the descending pitchfork’s lower median line (LML).

Its failure to reach the downtrend line signaled sellers’ strength. Only staying above the 126.94 and making a valid breakout through the downtrend line could signal that the downside movement ended.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money