- The USD/JPY has hit 135.00 for the first time in twenty years, fueling concerns over the yen’s weakness.

- Japan’s top officials are ready to “respond appropriately” to the yen’s weakness.

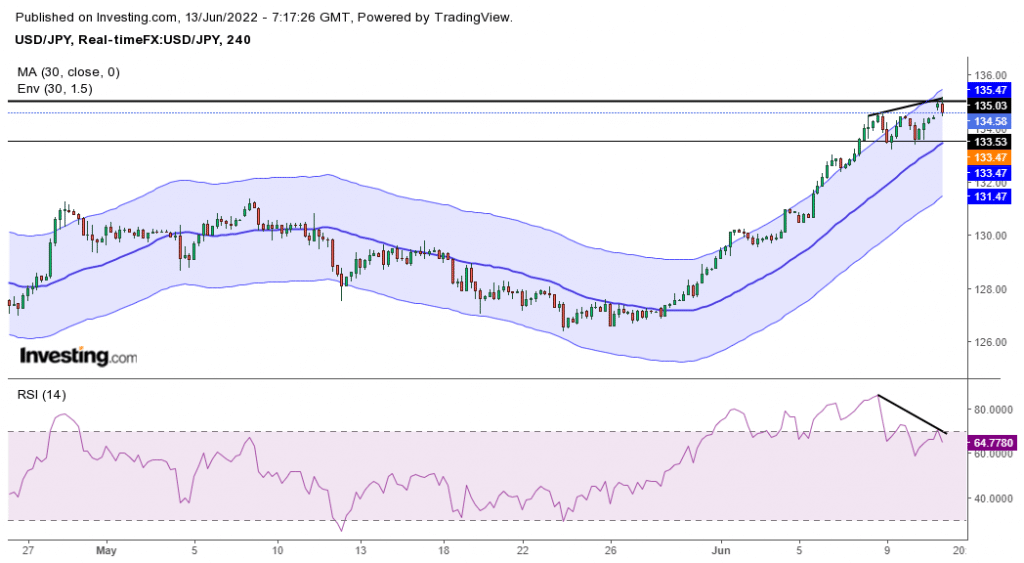

- The RSI shows a bearish divergence in the 4-hour chart.

The USD/JPY price fell as investors took profits at 135.00, pushing the pair lower on Monday morning. For the first time in 20 years, the pair surpassed 135, pushed by a rise in Treasury yields, with the 10-year period reaching 3.201%.

-Are you interested in learning about forex tips? Click here for details-

Two-year Treasury yields, which are very sensitive to policy expectations, went up as high as 3.159% in Tokyo on Monday, the highest since December 2007. The US dollar index, which measures the currency against six major peers, including the yen, reached 104.55 for the first time in nearly a month.

On Monday, Japan’s top government spokesperson said that Tokyo is concerned about sharp falls in the yen currency and is ready to “respond appropriately” if needed.

These remarks failed to stop the yen from plunging to its lowest since 1998 against the dollar. Hirokazu Matsuno, Chief Cabinet Secretary, said that currency rates should move in a stable way to reflect fundamentals. He said they were concerned about the recent sharp moves in the yen and would respond appropriately.

“The yen’s recent sharp declines are negative for Japan’s economy and therefore undesirable, as they make it hard for companies to set business plans,” Kuroda, the bank’s governor, told parliament on Monday.

Japan’s policymakers have started singing a different tune. However, the markets will wait to see if the recent weakness in the yen will push the Bank of Japan to follow in the path of other central banks.

USD/JPY key events today

The US and Japan will not be releasing any important economic news today, meaning the pair will continue to react to comments by Japan’s top officials.

USD/JPY price technical analysis: RSI forms bearish divergence at 135.00

Looking at the 4-hour chart, the price has been trading above the 30-SMA for some time now, showing a bullish trend. However, this trend might be coming to an end as the RSI is showing a bearish divergence. This divergence is more significant because it occurred at 135.00, critical resistance.

-Are you interested in learning about the forex basics? Click here for details-

The bearish divergence might push the price lower to 133.50. The trend will only turn bearish if the price breaks below 133.50 and pushes lower.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money