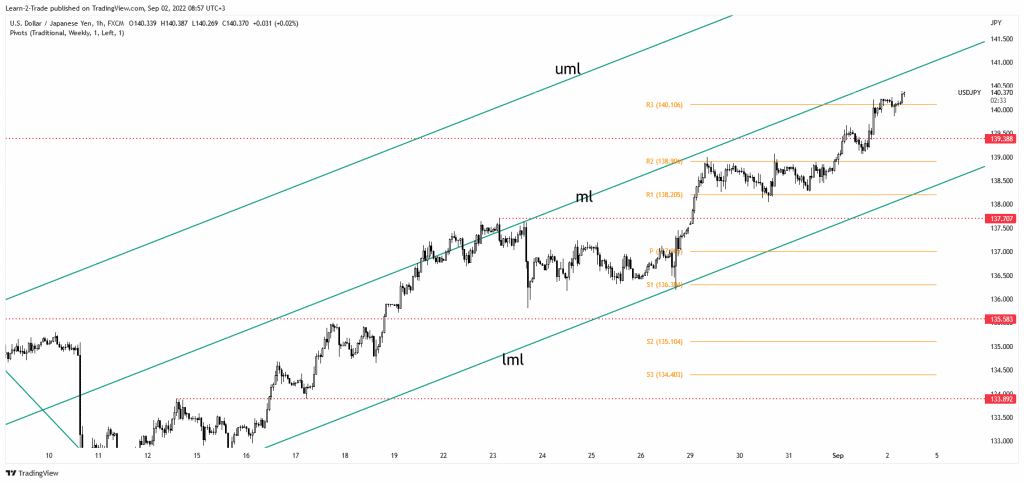

- The USD/JPY pair maintains a bullish bias despite temporary retreats.

- The median line (ml) represents an upside target.

- The US data could be decisive today.

The USD/JPY price extended the rally as the Dollar Index rallied while the Yen Futures dropped. The pair was trading at 140.33 at the time of writing. It looks determined to approach new highs. The bias is bullish, but it remains to see how it will react after the US data release. The USD/JPY pair technically activated further growth after jumping and stabilizing above 139.38.

-Are you interested in learning about the forex indicators? Click here for details-

Fundamentally, the Monetary Base rose by 0.4% less than the 3.1% expected. Today, the US data could be decisive. The Non-Farm Employment Change is expected at 295K, the Unemployment Rate could remain at 3.5%, while the Average Hourly Earnings may report a 0.4% growth in August.

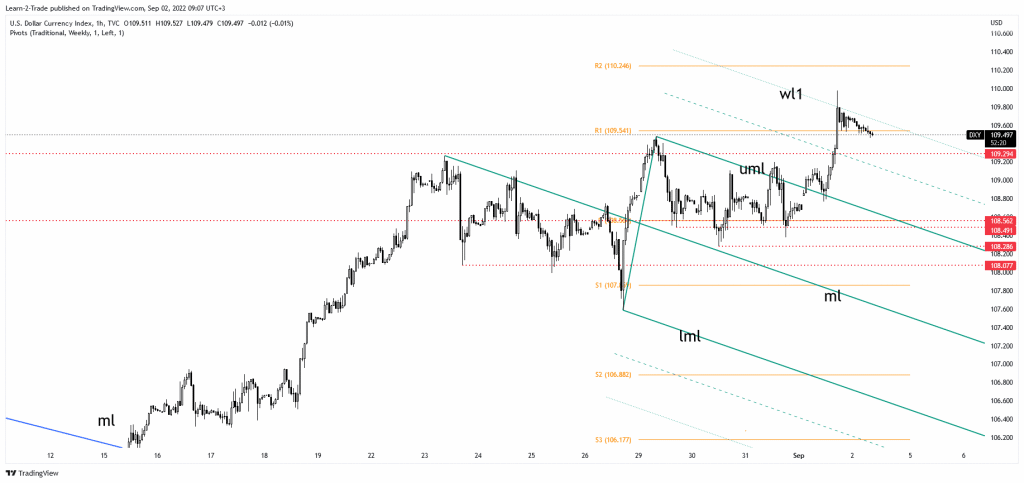

Dollar Index price technical analysis: Temporary retreat

The Dollar Index rallied in the last trading session as the US Unemployment Claims and the ISM Manufacturing PMI came in better than expected. It climbed as high as 109.97 and found a strong supply.

As you can see, the hourly chart has registered only a false breakout through the warning line (wl1). This represents a dynamic resistance, so it could come back to test the 109.29 critical level before resuming its growth. Taking out the resistance represented by the warning line (wl1) could activate further growth. This scenario could help the USD to dominate the currency market.

USD/JPY price technical analysis: Well above 140.00

You knew from my previous analysis that the USD/JPY pair could resume growth after consolidating the R1 (138.20) and the R2 (138.90). It has now jumped and stabilized above the 140.00 psychological level and the R3 (140.10), representing upside obstacles.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

Technically, the median line (ml) of the ascending pitchfork represents an upside target, a dynamic resistance. Better than expected, US data today could push the rate towards this line. Temporary retreats could bring new long opportunities. Only DXY’s sell-off and the Yen Futures’ rebound could force the USD/JPY pair to return to 139.38.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.