- The USD/JPY pair ended its corrective phase and seemed determined to resume its uptrend.

- A new higher high activates further growth.

- Dropping and stabilizing below the 50% retracement level could invalidate an upside continuation.

The USD/JPY price turned upside as the Dollar Index rebounded while the Yen Futures plunged. It was trading around 134.80 level at the time of writing. It looks poised to resume rally after testing the near-term downside obstacles.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Technically, the currency pair was in a corrective phase, but the retreat ended, and now it is attempting to resume its major uptrend. The price could lose altitude in the short term as the Dollar Index came back down after failing to take out a strong resistance level.

Fundamentally, the greenback received a helping hand from the US data on Friday. The Non-Farm Employment Change was reported at 528K above 250K estimated, the Unemployment Rate came in at 3.5% below 3.6% expected, while the Average Hourly Earnings rose by 0.5% exceeding the 0.3% forecasted.

On the other hand, the Japanese Household Spending and the Average Cash Earnings also came in better in the last trading session. Today, the Japanese Current Account was reported at 0.84T versus -0.03T expected, Bank Lending rose by 1.8%, beating the 1.5% forecasts, while Economy Watchers Sentiment came in at 43.8 points below 51.6 points estimated.

USD/JPY price technical analysis: Bullish bias

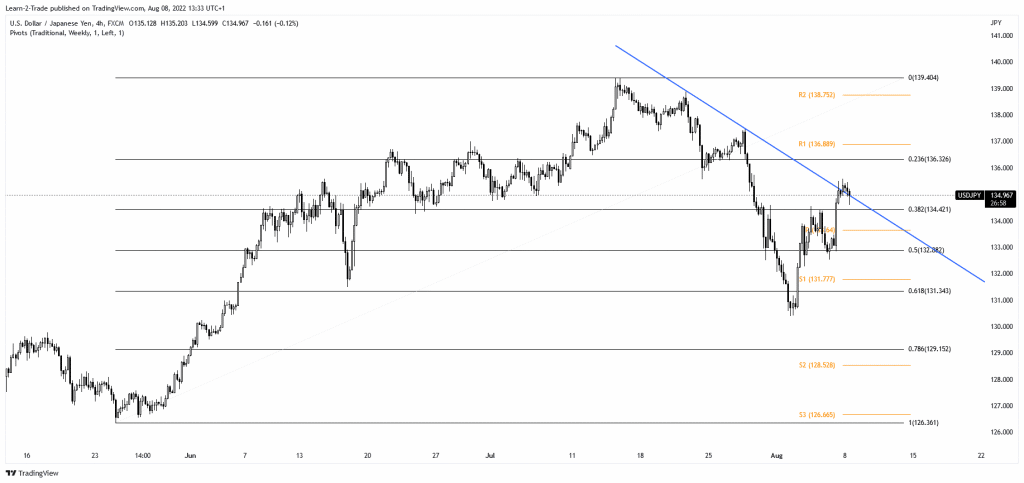

From the technical point of view, the USD/JPY price rebounded after failing to stabilize below 61.8% (131.34). Now, it challenges the descending trendline. A valid breakout through this dynamic resistance could signal further growth. Stabilizing above 38.2% (134.42) could attract more buyers. The weekly pivot point of 133.64 stands as a downside obstacle as well. The JPY could take the lead if the Dollar Index drops deeper and the Yen Futures rebound.

-Are you looking for the best CFD broker? Check our detailed guide-

A new higher high, jumping and closing above 135.58, could activate further growth. After its strong rally, the rate could retreat a little or try to move sideways. I think dropping and closing below the 50% (132.88) retracement level may invalidate an upside continuation and trigger a significant downfall.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.