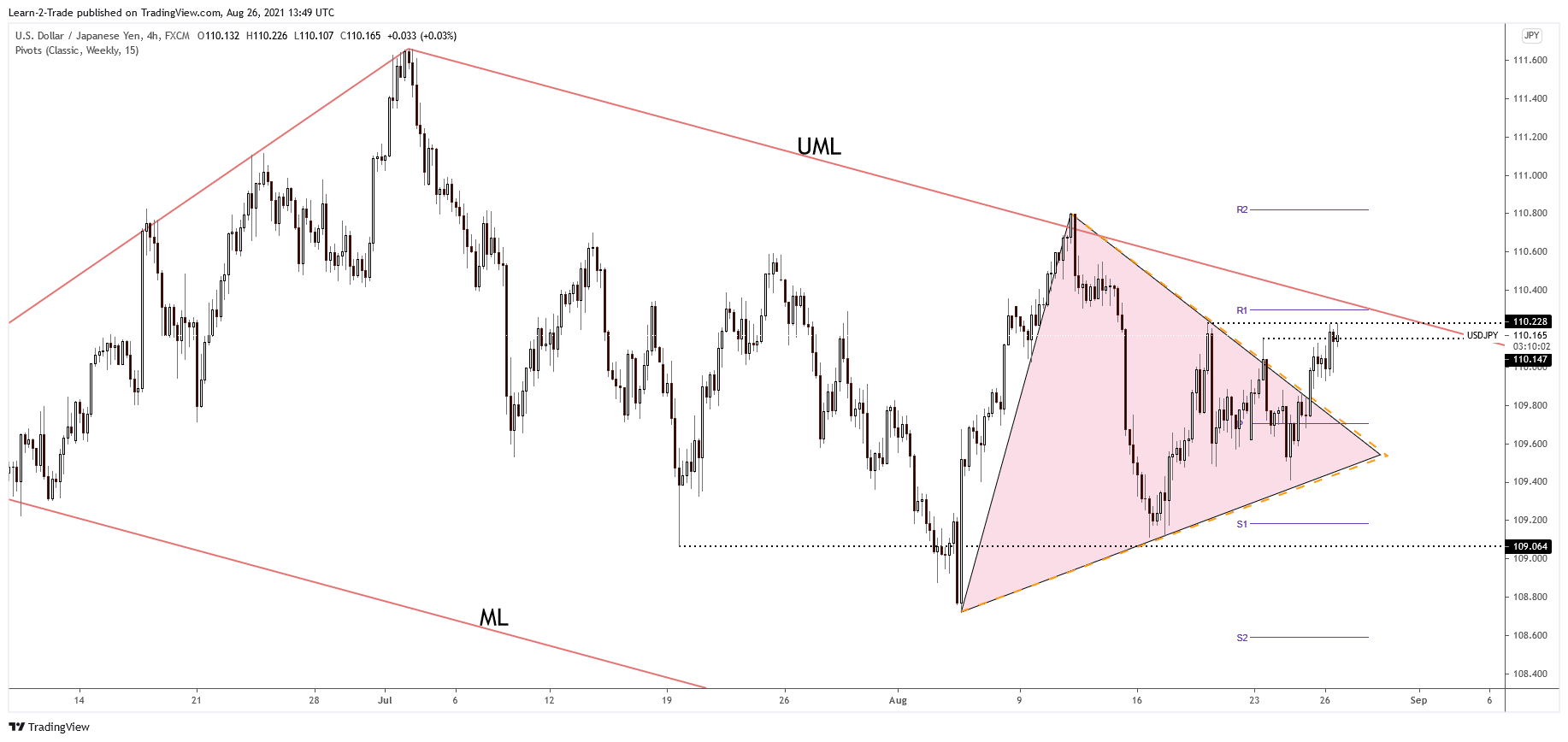

- The USD/JPY pair could develop an important growth if it makes a valid breakout through the upper median line (UML).

- The price increased as the Dollar Index, and the Japanese Yen are still bullish.

- Technically, the current upside movement was somehow expected after failing to approach and reach the 109.06 static support.

The USD/JPY price is bullish in the short term, but it has reached a resistance zone, so anything could happen here. Nevertheless, the price has managed to rise as the Dollar Index has rebounded. Also, the JP225, the Nikkei, stands higher even if it moves in range.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The United States economic data have come in worse than expected but are still good figures. The Dollar Index was into a support zone, so its current rally helps the USD appreciate its rivals. It remains to see how the Nikkei will react in the short term after ending its current sideways movement.

The US Prelim GDP has registered only a 6.6% in Q2 less compared to 6.7% expected. Still, it has come in better than expected compared to 6.5% growth in the previous reporting period. Also, the Unemployment Claims indicator was reported higher at 353K versus 349K reported in the previous reporting period. The specialists have expected a potential drop towards 345K in the previous week.

Tomorrow, the Fed Chair Powell speech delivered at the Jackson Hole Economic Policy Symposium could shake the markets.

USD/JPY price technical analysis: A probable breakout attempt

The USD/JPY pair has escaped from the triangle pattern and now is pressuring the 110.22 – 110.14 resistance area. The immediate major resistance is seen at the descending pitchfork’s upper median line (UML).

–Are you interested to learn more about forex bonuses? Check our detailed guide-

It moves somehow sideways after failing to stabilize under the 109.06 level. Its failure to approach and reach the descending pitchfork’s median line (ML) signaled a potential comeback to the upper median line (UML). The weekly R1 (110.29) is seen as resistance as well. A valid breakout above the upper median line (UML), 110.22, and through the R1 could activate an important upwards movement.

Technically, when the price fails to reach the median line (ML) of a descending pitchfork, it could register a strong growth after making a valid breakout through the upper median line (UML).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.