- The USD/JPY pair continues to move sideways, but the NFP could bring us a clear direction.

- Making a new higher high indicates that the USD/JPY could develop a border upwards movement.

- Escaping from the extended sideways movement could bring great trading opportunities.

The USD/JPY price continues to move within an extended range. Is trading in the red at the moment of writing at 109.93. The pressure is high after registering a false breakout with great separation through major resistance levels.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Maybe the US data dump could bring a clear direction on the USD/JPY pair. As you already know, the United States Non-Farm Payrolls will be released later and is expected around 720K in August, below 943K in July. In addition, the Unemployment Rate is expected to drop from 5.4% to 5.2%, while the Average Hourly Earnings indicator could gain by 0.3% versus 0.4% in July.

In addition, the ISM Services PMI is expected to drop from 64.1 points to 61.9 points signaling the expansion slowdown, while the FInal Services PMI could be reported at 55.2 points. These economic figures are seen as high-impact, so the markets could register sharp movements around these releases.

It remains to see how the USD will react around the NFP. Poor US data reported later today could weaken the greenback. DXY further announces USD’s depreciation. On the other hand, better than expected US figures could lift the Dollar Index and help USD/JPY rise.

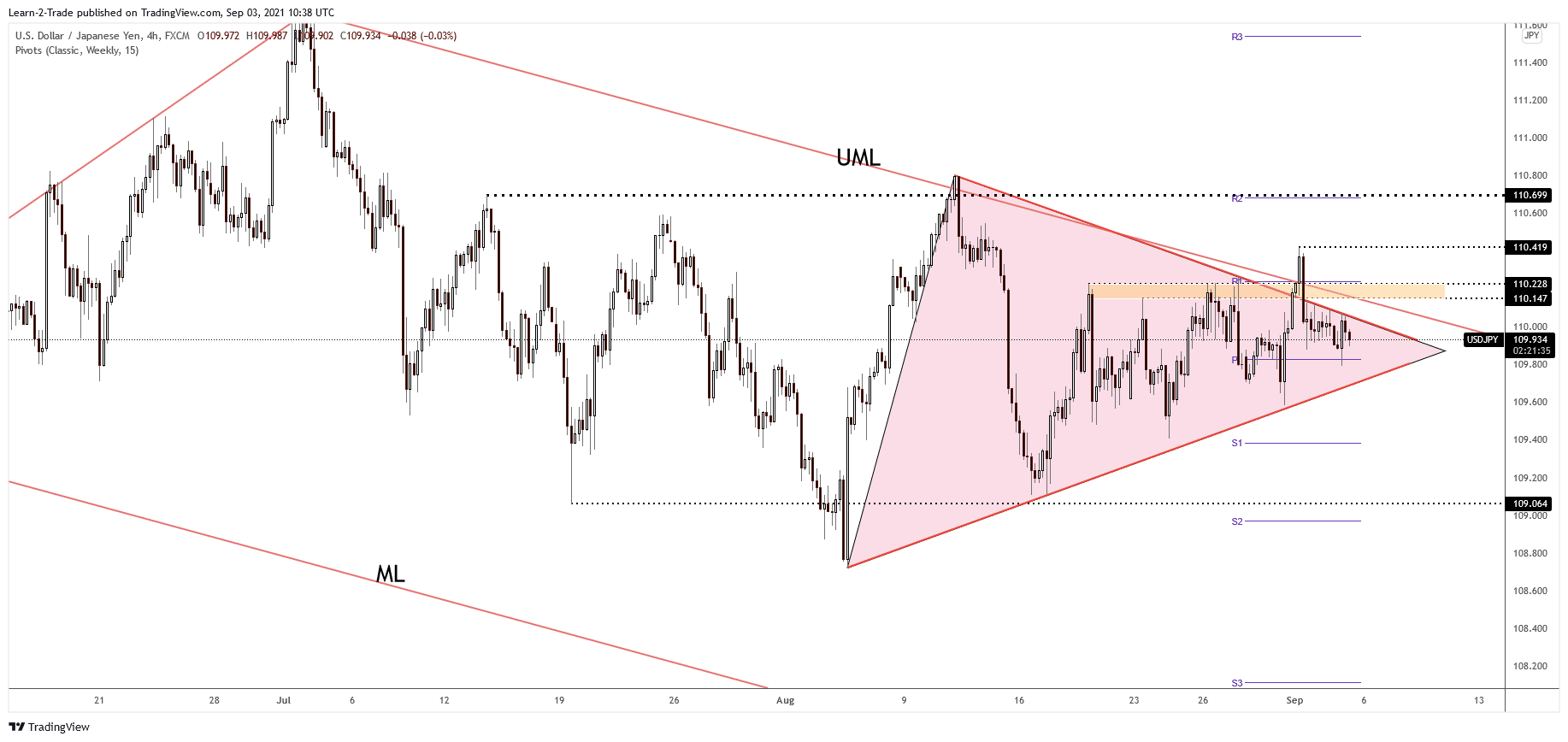

USD/JPY price technical analysis: Locked in a triangle

The USD/JPY pair drops right now after retesting the triangle’s resistance. As you already know, its false breakout through the upper median line (UML) and 110.22 – 110.14 signaled that the price could turn to the downside again.

–Are you interested to learn more about forex signals? Check our detailed guide-

Technically, it’s still trapped between 109.06 and 110.69 levels, So, the extended range could resume in the coming period. The USD/JPY pair could develop an important growth only after making a valid breakout through the descending pitchfork’s upper median line (UML). Staying near this dynamic resistance could signal a potential upside movement. From the technical point of view, jumping and stabilizing above 110.41 may signal larger upwards movement. The pair continues to stay higher after its false breakout as Nikkei’s rally weakens the Japanese Yen.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.