- USD/JPY drops like a rock as the JP225 and DXY are trading in the red.

- Where can USD/JPY find major support, demand?

- We could have new short opportunities if USD/JPY comes back to test and retest the broken levels.

The USD/JPY price plunged in the short term as the JP225, and the Dollar Index has dropped aggressively. It’s located at 109.31 level, and it seems very heavy, so further drop is favored. On the other hand, the Nikkei’s sell-off forced the Japanese Yen to increase versus its rivals.

JP225’s further drop may signal Yen’s further appreciation. Also, the USD could depreciate if the Dollar Index drops after the current rebound. USD/JPY also because the Japanese economic data have come in better than expected today.

The Revised Industrial Production increased by 6.5% versus 6.2% compared to 6.2% growth in the last reporting period. Furthermore, the Prelim GDP increased by 0.3% compared to 0.1% expected after a 0.1% drop in the previous reporting period, while the Prelim GDP Price Index dropped only by 0.7% versus 0.9% expected.

The US has published only the Empire State Manufacturing Index, reported at 18.3 in August versus 28.9 estimates and 43.0 in July. Tomorrow, the United States retail sales data could bring high volatility and high action on the USD/JPY.

USD/JPY price technical analysis: Strong sell-off to crack 109.00

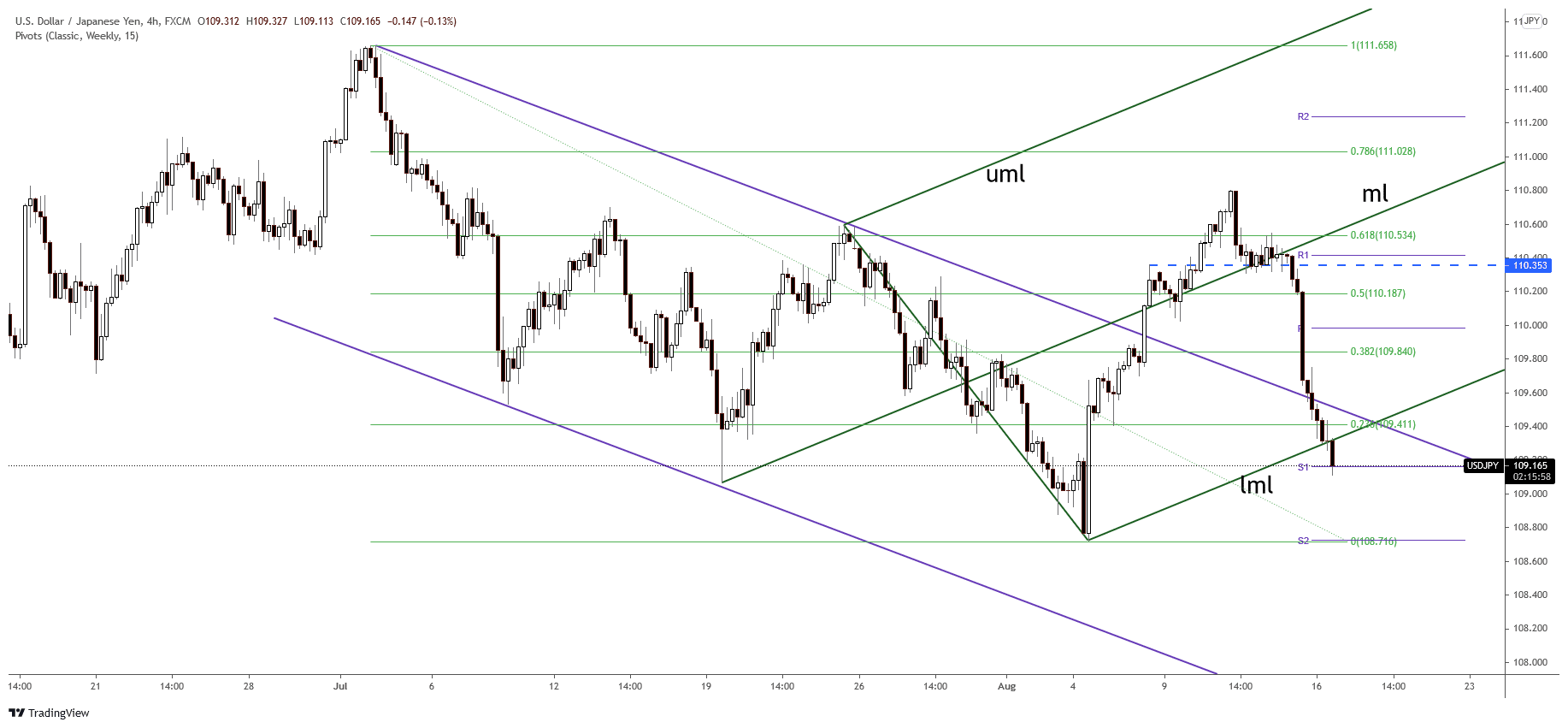

The USD/JPY pair plunged after failing to stabilize above the ascending pitchfork’s median line (ml). Now it is pressuring the 109.16 level weekly S1. Closing below it may signal further decline. It has escaped from the ascending pitchfork’s body, signaling strong sellers.

Unfortunately, the upside scenario was invalidated after dropping and closing below the downtrend line. Technically, the near-term downside obstacle is seen at a 108.72 lower low. The USD/JPY pair could find support there if it continues to drop.

Also, we cannot exclude a temporary rebound in the short term after the current aggressive sell-off. This scenario could take shape if the Nikkei increased or if the DXY increased significantly again.

We could only have a new short opportunity if the rate returned to test and retest the broken levels.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.