- The Japanese currency loses further ground today.

- Yields of the US 10-year note trade in daily lows.

- US flash PMIs, EIA report next on the docket.

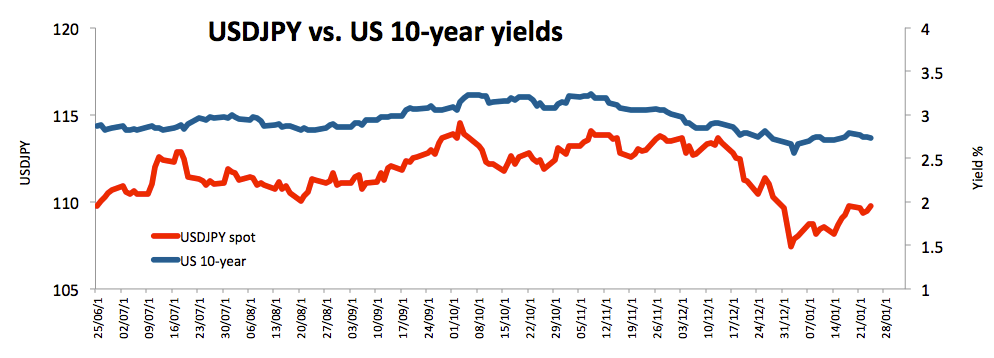

The better tone in the greenback plus declining yields in US money markets are lifting USD/JPY to the area of daily highs around 109.80.

USD/JPY looks to data, yields

The pair is up for the second straight session on Thursday, trading in session highs although a tad lower than yesterday’s 2019 peaks in the critical 110.00 neighbourhood.

The softer tone in yields of the US 10-year note, which are navigating in fresh lows in the vicinity of 2.73%, are also collaborating with the upbeat mood surrounding spot.

The selling bias in the Japanese currency has been recently supported by the steady stance from the Bank of Japan at its meeting earlier in the week, once again confirming that the central bank is one of the most dovish ones in the G10.

Later in the session, Markit’s advanced manufacturing and services PMIs are due in the US calendar ahead of the EIA report on oil inventories.

USD/JPY levels to consider

As of writing the pair is gaining 0.18% at 109.78 and faces the next up barrier at 109.99 (2019 high Jan.23) followed by 111.21 (200-day SMA) and then 111.40 (high Dec.26 2018). On the flip side, a breach below 109.20 (21-day SMA) would aim for 107.77 (low Jan.10) and then 104.65 (2019 low Jan.2).