- USD/JPY closed yesterday below the 200-day MA and ascending trendline.

- The bearish move seems to have boosted demand for JPY calls, the risk reversals show.

The USD/JPY pair closed yesterday below the 200-day moving average (MA) and the accelerated trendline (sloping upwards from March 26 low), opening doors for a deeper pullback towards the key support at 108.64.

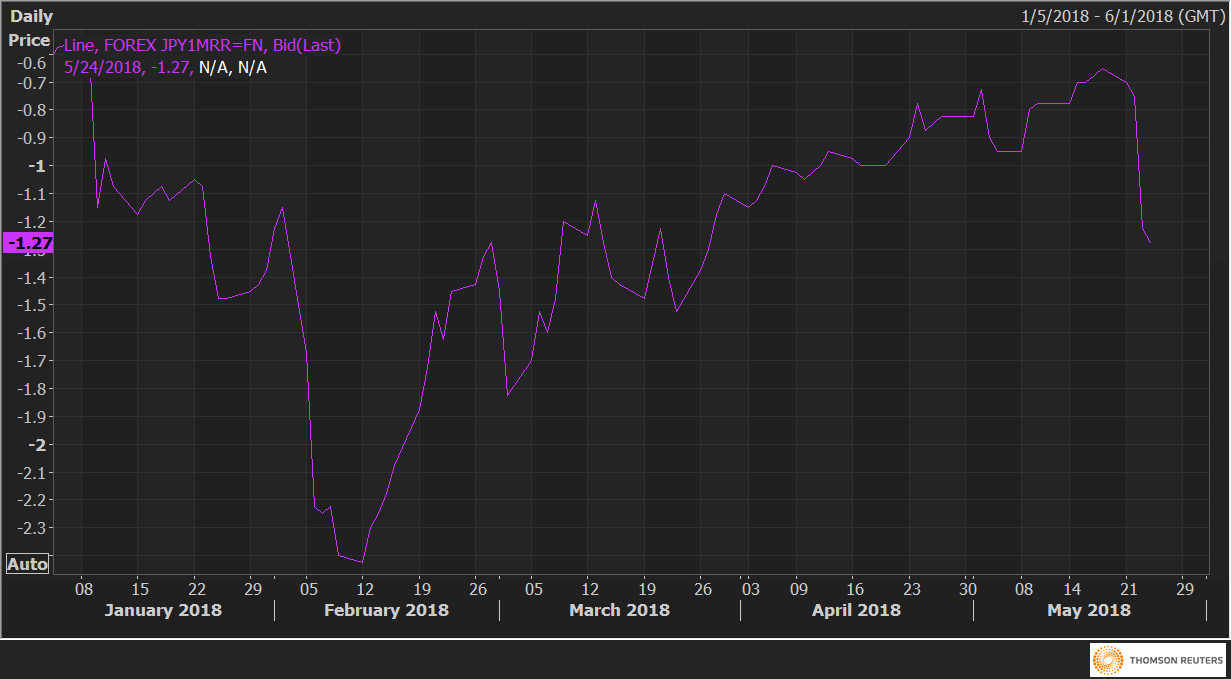

Consequently, the demand for the JPY calls (bullish bets) increased, pushing the USD/JPY one month 25 delta risk reversals (JPY1MRR) to -1.27 – the lowest level since March 27. A week ago risk reversals stood at -0.65.

The drop from -0.65 to -1.27 represents a rise in the implied volatility premium for the JPY calls (or demand for JPY calls has been rising), meaning the investors are hedging against a deeper pullback in the USD/JPY pair.

JPY1MRR