- USD/JPY risk reversals have hit three-week lows.

- The confirmation of short-term bearish reversal in USD/JPY seems to have revived interest in JPY calls.

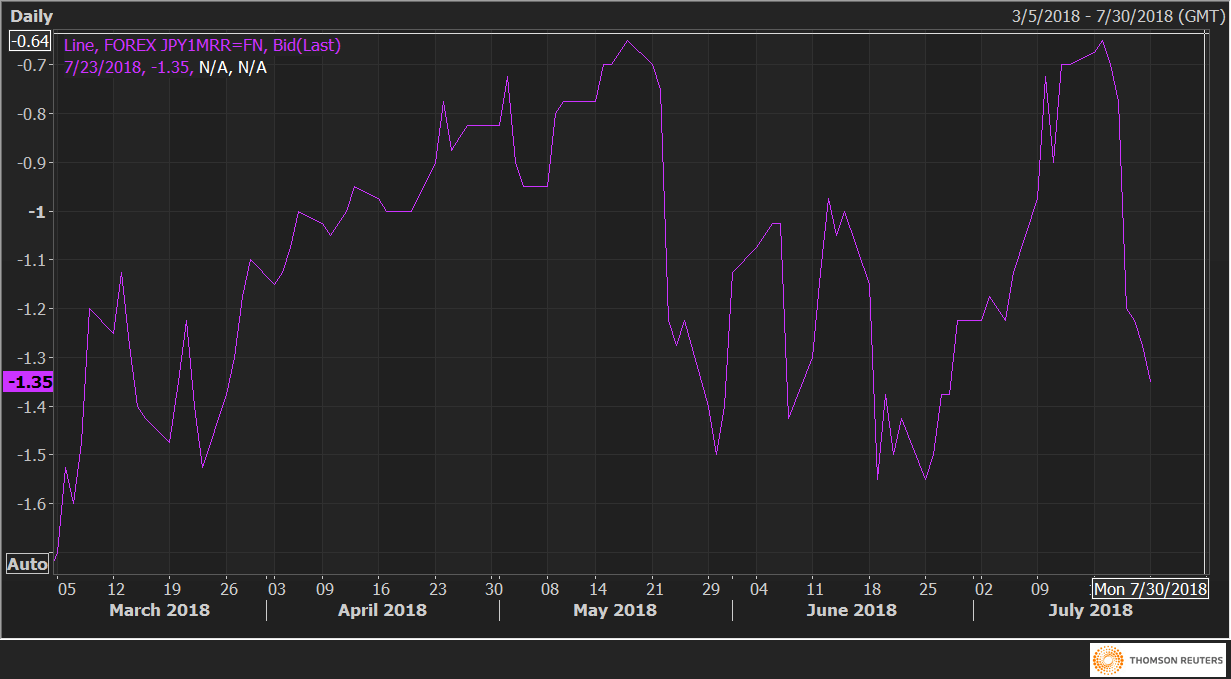

The USD/JPY one month 25 delta risk reversals (JPY1MRR) fell to -1.35 today – the lowest level since June 29 vs from -0.65 seen on last Tuesday, indicating a sharp rise in the demand or implied volatility premium for the JPY puts.

The data suggests the short-term bearish doji reversal in the USD/JPY spot has likely triggered fears of a deeper pullback and hence the investors are seeking downside protection (JPY calls or USD/JPY puts).

JPY1MRR