Dollar/yen rallied and reached the highest levels since February as everything went in favor of the pair. What’s next? The airstrikes in Syria may actually have a positive effect and then things depend on the Fed speakers, US retail sales and the mood of President Trump.

USD/JPY fundamental movers

Trade is improving and other reasons

The biggest driver forward of the pair is trade wars, or perhaps trade peace. After the US and China ramped up the rhetoric, the past week has seen talk about talking and reaching deals. The exchange of pleasantries between the world’s No. 1 and No. 2 economies also helped Japan, the world’s No. 3.

Moreover, Trump is now considering rejoining the Trans-Pacific Partnership which is dear to Japan. Further trade means a lower need for the yen, the ultimate safe haven currency.

The US Dollar had its own reasons to rise: the FOMC Meeting Minutes showed growing confidence among members regarding rising inflation and the need to raise rates. They were also confident of inflation reaching its goal and indeed, core inflation finally topped 2% and hit 2.1%.

This contrasts with Japan, where Governor Kuroda reiterated the need for monetary stimulus until the target is reached, defying speculation for an early withdrawal of stimulus.

Syria was initially a driver of the yen to higher ground. After the Assad regime gassed its citizens on April 7th, tensions rose and fears of a US-Russia clash rose. However, the airstrikes by the US, the UK, and France were quite cautious and there may be no additional action. So, a relief rally has good chances.

Reaction to Syria strikes, US retail sales, and Fed speakers

Assuming no additional escalation in the Middle East, USD/JPY could gap higher and perhaps even top the 108 level. Later on, it is back to normal business. The most important economic indicator is US retail sales on Monday. An acceleration in the volume of sales is on the cards.

Afterwards, no less than 6 different FOMC members will speak during the week, some of them more than once. The most interesting speech comes from John Williams, which has been promoted from the San Francisco Fed to the New York Fed, serving as a de-facto No. 2.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

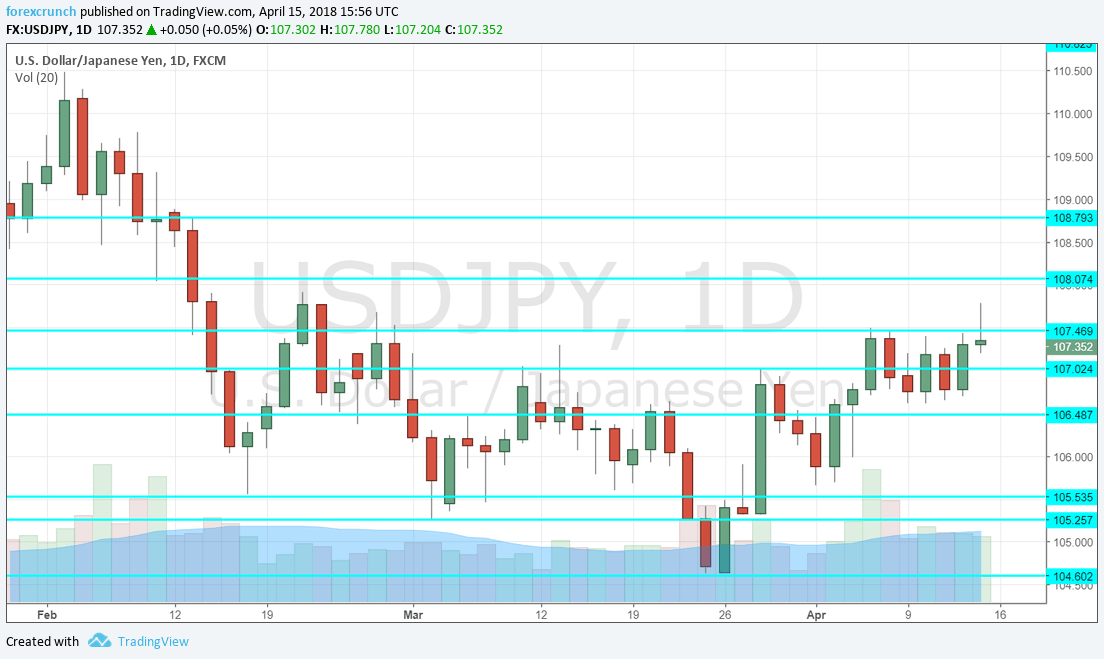

110.70 that was a separator of ranges in June and remains important. The round number of 110 serves as a psychological level.

109 was a pivotal line within the range. 108.30 was the low seen in late January. Even lower, we find 107.50 capped the pair in early April and is a strong line.

106.50 was a resistance line in mid-February. and then resistance in early March. 105.55 was the first swing low.

USD/JPY Daily Chart

USD/JPY Sentiment

I am neutral on USD/JPY

The pair managed to make a meaningful recovery and is looking for a new direction. Worsening trade relations between China and the US may push it lower, but assuming no disaster for now, we may see it consolidating the recent move.

Our latest podcast is titled Volatility venting and Brexit can-kicking

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!