- USD/JPY dropped sharply and suffered a “flash crash.”

- Inflation and services data stand out in the first full week of 2019.

- The pair looks oversold, but that does not mean it will rise

This was the week: Flash crash as fears grow

Worries about the state of the Chinese economy, the world’s second-largest, weighed on stocks and pushed funds into the safety of the safe-haven yen. Both official and unofficial PMI pointed to a contraction in the manufacturing sector. US President Donald Trump tweeted about a good conversation he had with his counterpart Xi Jinping on trade. However, markets remain skeptical about the prospects of a deal and the damage to the global economy has already been done.

And then came Apple. The tech giant issued a revenue warning pointing to an unexpectedly substantial slowdown in China leading to a fall in iPhone sales. CEO Tim Cook mentioned trade wars. The announcement came in the illiquid hours after the US session had ended and as Tokyo was closed for a bank holiday. USD/JPY crashed from around 109 to just below 105 before stabilizing below 108.

The flash crash was also felt in other currencies, most notably the Aussie and the Turkish Lira. The consequent jitters in equity markets did not help.

One reason for the recovery of the pair was fear that the Bank of Japan may interfere. Governor Haruhiko Kuroda reserves the right to jump into markets when there are excessive moves, and the 4% drop is undoubtedly a wild one.

While the ADP NFP beat to the upside, with 271K, markets focused on the plunge in the ISM Manufacturing PMI. The fall from 59.3 to 54.1 represents a critical slowdown. It came on top of dovish comments from FOMC member Robert Kaplan. The President of the Dallas Fed said he does not support a hike in H1 2019 and also opened the door to halting the balance sheet reduction process. The dovish words and weak data weighed on the greenback.

US events: Services survey, FOMC Minutes, and inflation

The first Monday of 2019 features the ISM Non-Manufacturing PMI for December which is projected to drop from the high score of 60.7 it saw back in November. The gauge stands on its own this time, not serving as a hint towards the NFP. Factory orders and a speech from the FOMC’s Raphael Bostic, a dove, stand out.

Another Fed speaker is scheduled for Wednesday: Eric Rosengren, which used to be a dove in the past but turned hawkish. More importantly, the FOMC Minutes are released later in the day.

Just before the holidays, Fed Chair Jerome Powelloversaw a rate hike that was slightly dovish: the dot-plot reflected only two moves in 2019 against three in the previous forecast. However, markets had expected a slash to one or none. Worse for stocks and USD/JPY, he confirmed that the Fed would continue reducing the balance sheet on “auto-pilot.” Some had expected the Fed to stop Quantitative Tightening.

New Home Sales will be of interest on Thursday, as the housing sector remains the weaker link. Friday features the all-important inflation report. The most significant number, Core Consumer Price Index YoY, accelerated to 2.2% in November. The Fed will watch the December report and the overall figure for 2018. Headline CPI also stood at 2.2% and could drop due to falling oil prices.

As usual in the US, Trump’s tweets also move markets. Hopeful comments on talks with China tend to lift USD/JPY and talk about new tariffs bring it down.

Also, the political scene may heat up. Democrats took over the House and may initiate not only budget proposals but also investigations on Trump’s business dealings as the Mueller investigation continues.

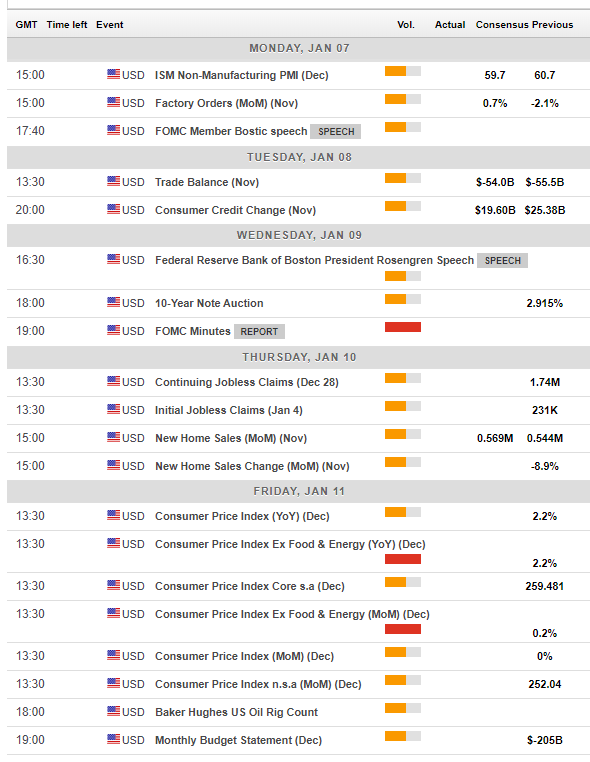

Here are the top US events as they appear on the forex calendar:

Japan: Sailing with stocks, intervention eyed

Prices of equities, especially those in Wall Street, will continue having a significant impact on USD/JPY. The safe-haven yen enjoys flows when stocks are down.

The Japanese calendar features only second-tier figures such as Overall Household Spending, but the BOJ may dominate the scene if the currency appreciates.

The Tokyo-based institution may intervene if the yen goes too far and too fast. If dollar/yen marches quickly towards 100, we may see a pullback. A move back up may be due to fear of intervention, verbal intervention (threats to sell yen), and not necessarily by an actual move in the markets.

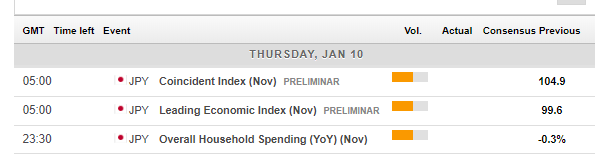

Here are the events lined up in Japan:

USD/JPY Technical Analysis

The Relative Strength Index (RSI) on the daily chart is just below 30, indicating oversold conditions. This implies a bounce, but the bulls remain in control. Momentum is to the downside, and the pair broke below the 200 Simple Moving Average.

107.50 served as a temporary bottom after dollar/yen stabilized and also capped it back in April 2018. 106.50 was a stubborn support line at the same time. The round number of 105 is eyed by the BOJ and by others. 104.60 was the low point in 2018.

108.10 was a swing low in the spring of 2018. It is followed by 108.50 which was the initial swing high after the flash crash. 109.20 provided support in June 2018, and 109.70 was a trough in the summer of last year.

All in all, the charts imply a short-lived recovery before another downfall.

USD/JPY Sentiment

The global economy is slowing down, and the safe-haven yen may find quite a bit of demand. If the Fed takes a dovish shift, that may improve the mood but will not help the greenback too much. All in all, there is room for further falls.

The FXStreet forex poll of experts provides intriguing insights.

-636821936390261113.png)