- The Dollar is gaining on the safe haven Japanese Yen as Tuesday winds through markets.

- Data for the week remains mid-tier for both major currencies, and market sentiment is taking the opportunity to swing risk-prone.

The USD/JPY is climbing into 110.10 as the US Dollar recovers across the broader market, grinding higher against the majority of G10 currencies in Tuesday’s Asian trading window.

The Dollar-Yen pairing is lifting into familiar resistance territory after the pair priced in a high in May of 111.40, before slipping back into 108.10, but the USD/JPY is now back into familiar territory as USD bulls continue to push the Dollar higher while the safe haven Yen relaxes with market participants letting trade tensions between the US and China ease, at least for now.

The JPY’s next meaningful data point will be coming late on Tuesday at 23:50 GMT, with m/m Machinery Orders for May expected at -5.5% compared to the previous reading of 10.1%.

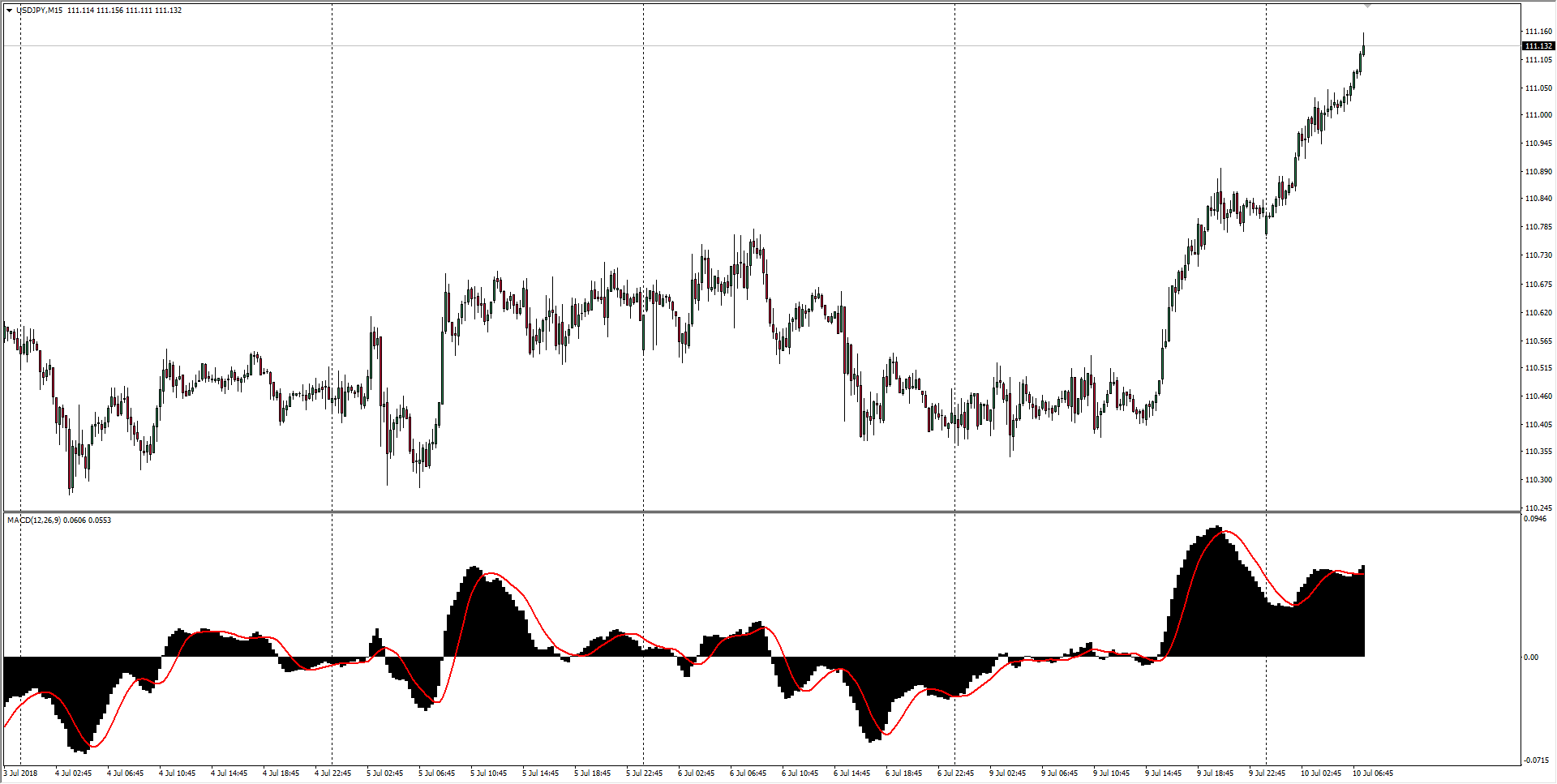

USD/JPY Technical analysis

Risk appetite is on the rise, and the Dollar is driving higher against the JPY, lifting above the 111.00 key barrier. The USD/JPY has been pricing in consecutive higher lows across higher timeframes, and Greenback bulls will be looking to extend momentum as the USD/JPY edges closer towards flipping 2018 into a net-positive year.

| Spot rate: | 111.13 |

| Relative change: | 0.32% |

| High: | 111.15 |

| Low: | 110.76 |

| Trend: | Bullish |

| Support 1: | 110.76 (current day low) |

| Support 2: | 110.36 (current week low) |

| Support 3: | 109.36 (one month low) |

| Resistance 1: | 111.87 (R3 weekly pivot) |

| Resistance 2: | 112.00 (major technical level) |

| Resistance 3: | 112.38 (R2 monthly pivot) |

USD/JPY Chart, 15-Minute