- USD/JPY feels the pull of gravity as Trump criticizes Fed for higher rates and USD, accuses China and EU of FX manipulation.

- BOJ speculation may have put a bid under JPY.

The USD/JPY pair fell to a three-week low of 110.75 as USD sell-off gathered pace on rising fears of Sino-US currency war and on speculation that BOJ might make changes to its stimulus program.

Trump bemoaned FX manipulation, stronger USD

The US President Trump criticized the Fed’s rate hike plans and accused China and the EU of currency manipulation on Friday, triggering a broad based pullback in the USD. Moreover, a significant majority in the market now fears the Sino-US trade war could turn into a full-blown currency war.

Further, Trump upped the ante on trade war front by stating he is ready to impose tariffs on all $505 billion worth of Chinese goods imported to the US.

Meanwhile, sources told Reuters that Bank of Japan (BOJ) is considering making adjustments to its stimulus program to make it more sustainable, meaning the central bank might slowdown the pace of bond/ETF purchases. After all, the central bank already owns more than 50 percent of the ETF market and hence may have to announce a “slower for longer” policy.

As a result, the oversold JPY may have picked up a bid.

However, it is worth noting that the market still expects the Fed to hike rates 1.5 times more this year. Further, the 10-year treasury yield is holding around the three-week high of 2.89 percent, which indicates the markets do not expect the Fed to veer from its gradual tightening path, despite Trump’s criticism.

Hence, the current sell-off could be short-lived. At press time, the currency pair is trading at 110.95.

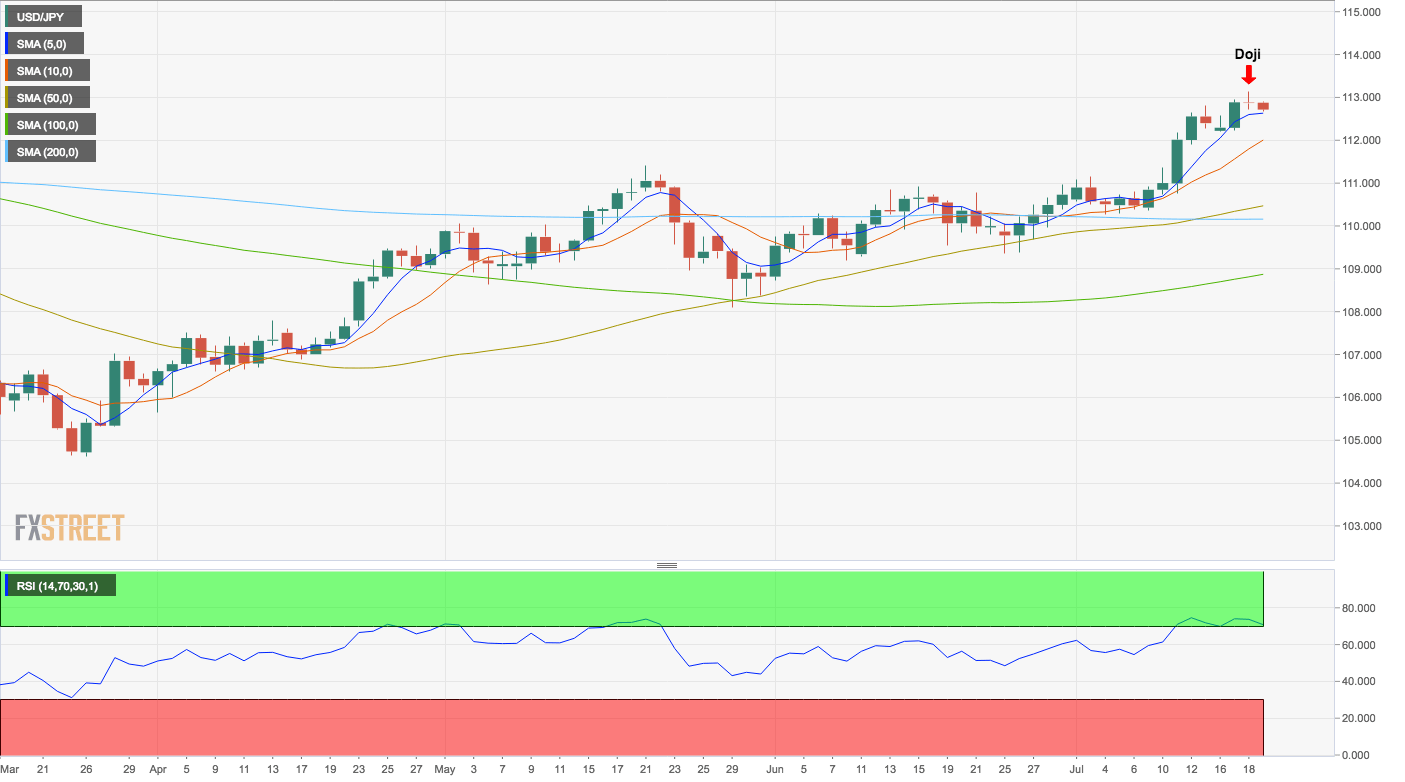

The hourly chart shows oversold conditions, hence we could be in for a bout of consolidation.

Hourly chart

Spot Rate: 110.95

Daily High: 111.50

Daily Low: 110.75

Trend: Consolidation likely

Resistance

R1: 111.15 (rising trendline resistance)

R2: 111.40 (May 21 high)

R3: 111.50 (session high)

Support

S1: 110.52 (50-day MA support)

S2: 110.29 (July 5 low)

S3: 110.00 (psychological support)