“¢ Trump’s comments continue to weigh on the USD.

“¢ Risk-off mood benefits JPY and adds to the selling bias.

The USD/JPY pair held on to its weaker tone through the mid-European session and is currently placed at the lower end of its daily trading range, around the 112.25-20 region.

The US President Donald Trump’s comments on Thursday, during an interview with CNBC, expressing displeasure about the Fed’s monetary tightening, kept the US Dollar bulls on the defensive and exerted some downward pressure.

In the second part of the interview, aired this Friday, Trump showed readiness to impose tariffs on all $505 billion of Chinese goods imported to the US if China does not back down on its trade policies and resurfaced fears of a full-blown global trade war.

This coupled with a weaker tone across European equity markets boosted the Japanese Yen’s safe-haven appeal and further collaborated to the pair’s weaker tone on the last trading day of the week.

Technical Analysis

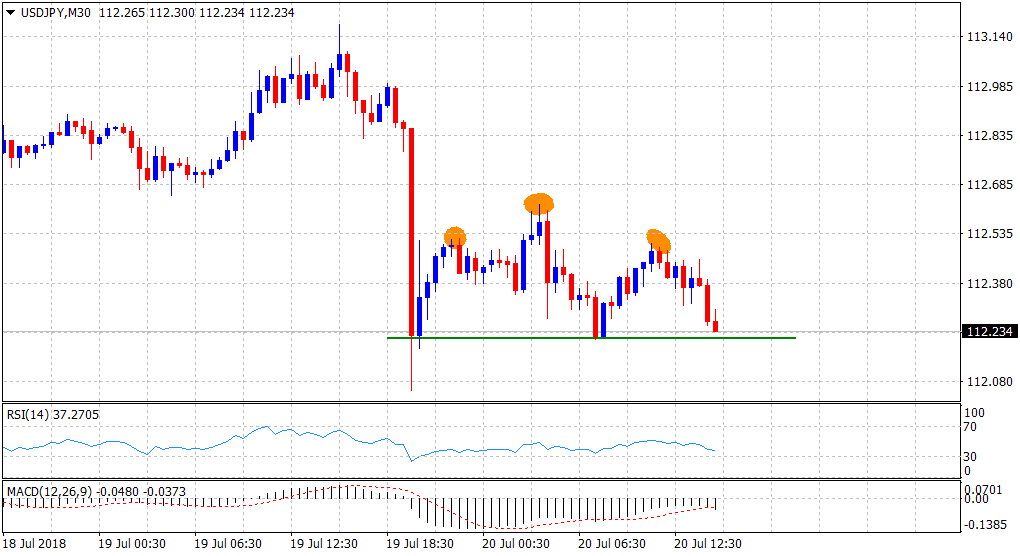

The pair now seems to have formed a bearish head & shoulders chart pattern on the 30-mins. chart and the same would be confirmed on a decisive break below the neckline support.

Technical indicators on the said chart are holding in negative territory and hence, support prospects for an extension of the corrective slide, amid absent market moving economic releases.

Spot rate: 112.23

Daily High: 112.62

Trend: Bearish

Resistance

R1: 112.62 (current day swing high)

R2: 113.08 (R1 daily pivot-point)

R3: 113.39 (YTD tops set on Jan. 8)

Support

S1: 112.05 (overnight 1-week low)

S2: 111.80 (bearish H&S breakdown target)

S3: 111.44 (S2 daily pivot-point)