“¢ The ongoing USD retracement fails to assist to build on the early uptick.

“¢ Cautious mood/subdued US bond yields exert some additional pressure.

“¢ Dip-buying interest is likely to limit any meaningful corrective slide.

The USD/JPY pair retreated around 20-25 pips from an intraday high level of 112.56 and might now be headed back towards the lower end of its daily trading range.

A fresh wave of US Dollar selling pressure since the early European session, coupled with a cautious mood around equity markets, which tends to underpin the Japanese Yen’s safe-haven appeal failed to assist the pair to build on its early uptick.

Meanwhile, a subdued action around the US Treasury bond yields did little to impress the bulls and held traders back from placing any aggressive bets ahead of an important release of the US monthly retail sales data.

Apart from influential US macro data, the Fed Chair Jerome Powell’s testimony on Tuesday and Wednesday will play a key role in determining the pair’s next leg of directional move.

Technical Analysis

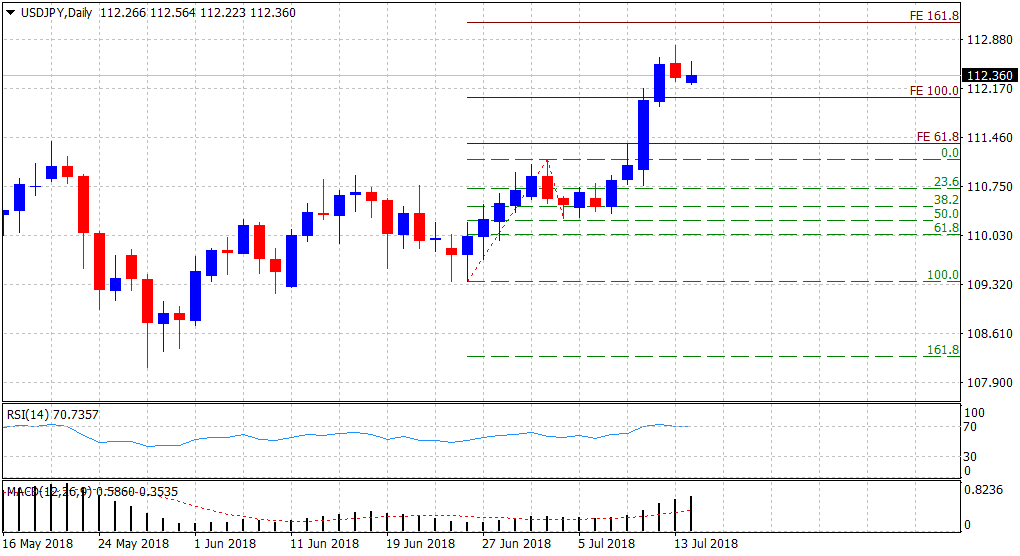

Looking at the technical picture, the recent price action over the past two trading sessions might still be categorized as consolidative in nature, especially after last week’s strong upsurge of near 250-pips.

With short-term technical indicators easing from near-term overbought conditions, dip-buying interest might help limit any meaningful corrective slide, at least for the time being.

Spot rate: 112.36

Daily High: 112.56

Daily Low: 112.22

Trend: Bullish

Support

S1: 112.03 (100% Fibo. expansion level of the 109.37-111.14 up-move and subsequent retracement)

S2: 111.62 (S3 daily pivot-point)

S3: 111.40 (previous strong resistance break-point)

Resistance

R1: 112.80 (6-month tops set on Friday)

R2: 113.00 (round figure mark)

R3: 113.28 (R3 daily pivot-point)