“¢ Bulls fail to capitalize on the early uptick, despite a combination of supporting factors.

“¢ Resurfacing US-China trade war fears prompt some safe-haven buying.

“¢ Trader seemed inclined to take some profits off the table ahead of the FOMC decision.

The USD/JPY pair surrendered a major part of its early gains to 1-1/2 week tops and has now retreated back below the 112.00 handle.

The latest leg of retracement from the late Asian session high level of 112.15 lacked any obvious fundamental catalyst and could be attributed to some profit-taking, especially after a strong up-move of nearly 150-pips over the past 24-hours or so.

Even a follow-through US Dollar buying interest and a goodish pickup in the US Treasury bond yields did little to provide any fresh bullish impetus, with cautious mood around equity markets, led by reviving trade-war fears, underpinning the Japanese Yen’s safe-haven appeal and prompting some long-unwinding.

Moving ahead, the release of US ADP report on private sector employment followed by the ISM manufacturing PMI might provide some trading impetus ahead of the latest FOMC monetary policy update, due later during the New-York trading session.

Technical Analysis

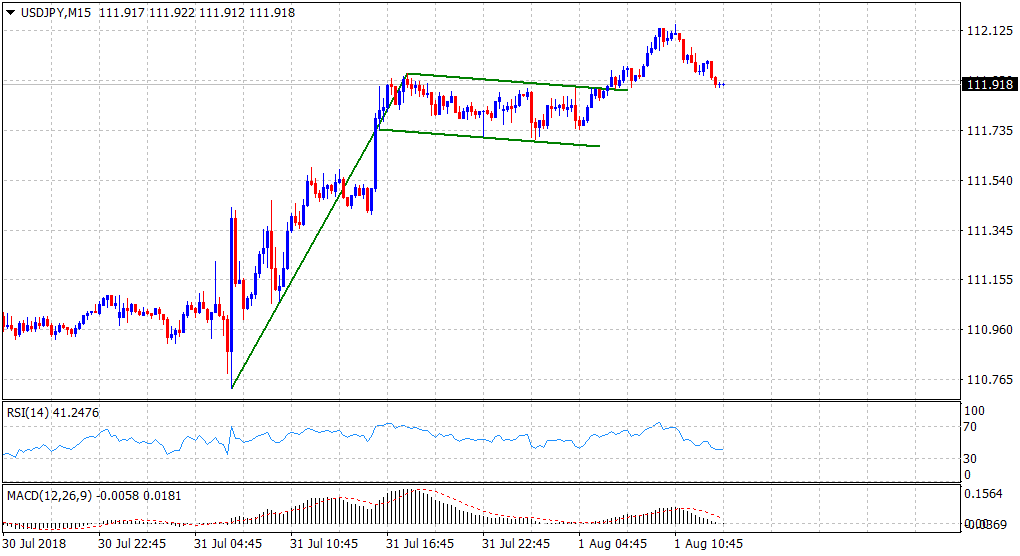

During the Asian session on Wednesday, the pair confirmed a bullish breakout through a flag chart pattern on the 15-minute chart, signalling a continuation of the upsurge from the post-BoJ swing low level of 110.73.

The positive momentum, however, already seems to have lost steam, while technical indicators on the daily chart still support prospects for some fresh dip-buying interest at lower levels.

Hence, any follow-through slide is likely to find decent support near mid-111.00s, which if broken might negate the bullish bias and turn the pair vulnerable to head back towards challenging the 110.70-60 support area.