- USD/JPY has traded higher on the 104 area as investor’s sentiments begin to flake.

- Brexit risk is back to the fore as talks fail to conclude with a deal, so far.

USD/JPY is trading at 104.30 having travelled between a low of 104.13 and 104.30 for the Asian session so far.

This followed USD/JPY rise from 104.05 to 104.41 overnight on a recovering US dollar and soft performances in equities.

US equities fell as US fiscal relief negotiations remained deadlocked and amidst an elusive Brexit deal arrangement.

Congress can’t move forward all of the whiles that Democrats demand aid for state and local governments and Republican demands are for shielding businesses from Covid liability.

Senate Majority Leader McConnell said Democrats “poured cold water” on his offer to set aside some issues in a fiscal relief bill and rebuffed Treasury Secretary Mnuchin’s $900bn proposals.

In the US Congress, House lawmakers were voting to pass a one-week stopgap funding bill to give more time for talks.

Brexit moves to the fore

As for Brexit, British Prime Minister Boris Johnson warned the European Union on Wednesday it must scrap demands that he says are unacceptable if there is to be a Brexit trade deal to avoid a turbulent breakup in three weeks.

Brexit update: Very large gaps remain between the two sides

A senior UK source has said that very large gaps remain between the two sides and it has been agreed that by Sunday a firm decision should be taken about the future of the talks.

The European commission president Ursula von der Leyen also stated, ”we gained a clear understanding of each others´ positions. they remain far apart.”

Bank of England Governor Andrew Bailey has warned a no-deal Brexit would cause longer-term damage to Britain’s economy than the COVID-19 pandemic, and the impact of the change might be felt for decades.

DXY picks up a safe haven bid

The yen and US dollar would be expected to benefit from sterling weakness.

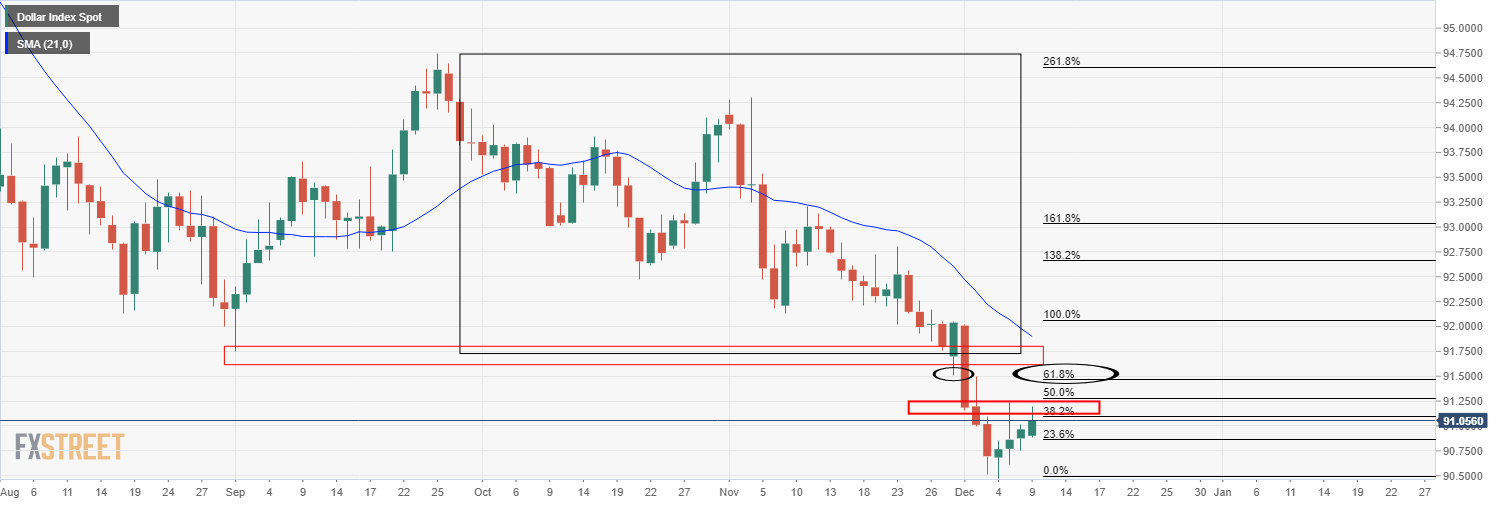

As for the US dollar, the dollar index was up 0.2% on the day:

The greenback, which tends to fall when risk appetite is strong, held firm against other major currencies as it stood at 91.029 off Friday’s 2 1/2-year low of 90.471.

US 2yr treasury yields ranged between 0.15% and 0.16%, while the 10yr yield ranged between 0.93% and 0.96%.

The November CPI is set to print precariously close to the deflation threshold, and will remain an ongoing concern for the Fed (market f/c: 0.1%). Following this, we will receive a clearer signal of initial jobless claims in the wake of the Thanksgiving holiday (market f/c: 725k). The monthly budget statement should narrow, but will remain elevated (market f/c: -$200bn).