- USD/JPY risk reversals dropped to one-month lows today, indicating a rising demand for JPY puts.

- BOJ speculation and the fears of a deeper drop in the USD/JPY may have forced investors to buy cheap out-of-the-money JPY calls (buy JPY).

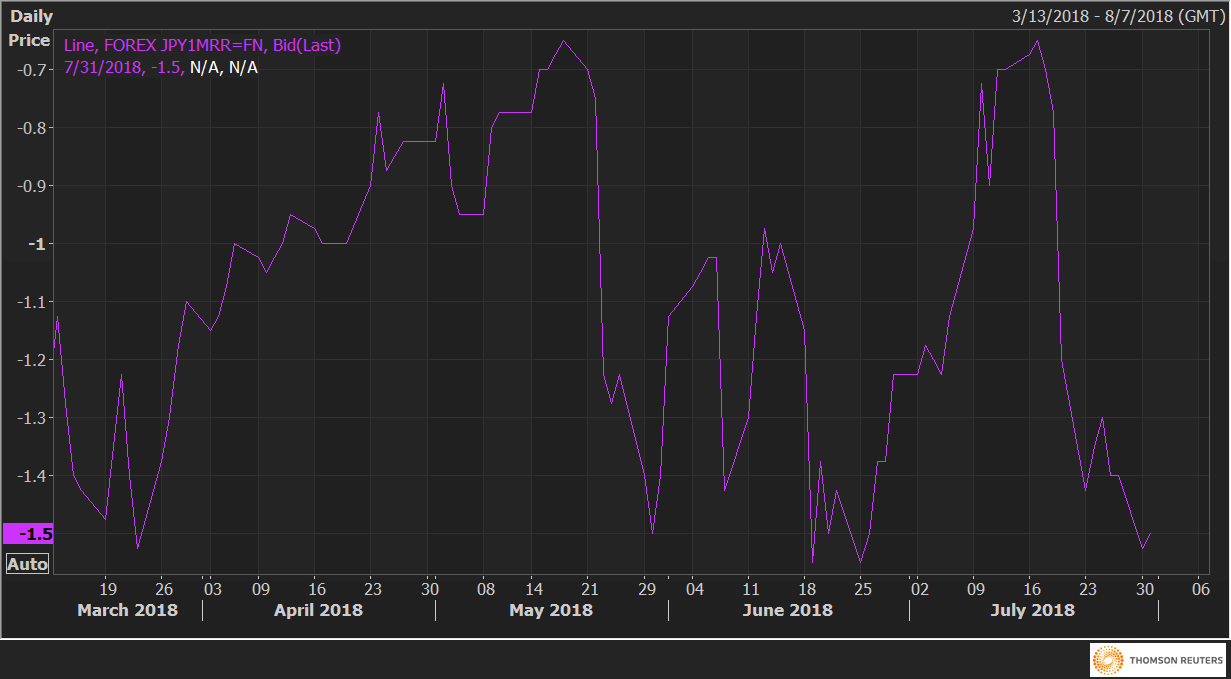

The USD/JPY one-month 25 delta risk reversals (JPY 1MRR) fell to -1.5 – the lowest level since June 26, indicating a rising implied volatility premium or rising demand for JPY call options (bullish bets).

About two weeks ago, the risk reversals gauge stood at -0.7.

Interestingly, the sharp decline from -0.7 to -1.5, representing an increased demand for JPY calls, has coincided with a speculation that the Bank of Japan (BOJ) would tweak its policy to make it more sustainable.

So, an argument can be made that investors have likely bought hedges (JPY calls) on fears the BOJ might deliver a hawkish policy tweak on July 31, sending the USD/JPY well below the 110.00 mark.

JPY1MRR